The economy is booming and it might be a problem

Will the Fed pause tightening conditions anytime soon?

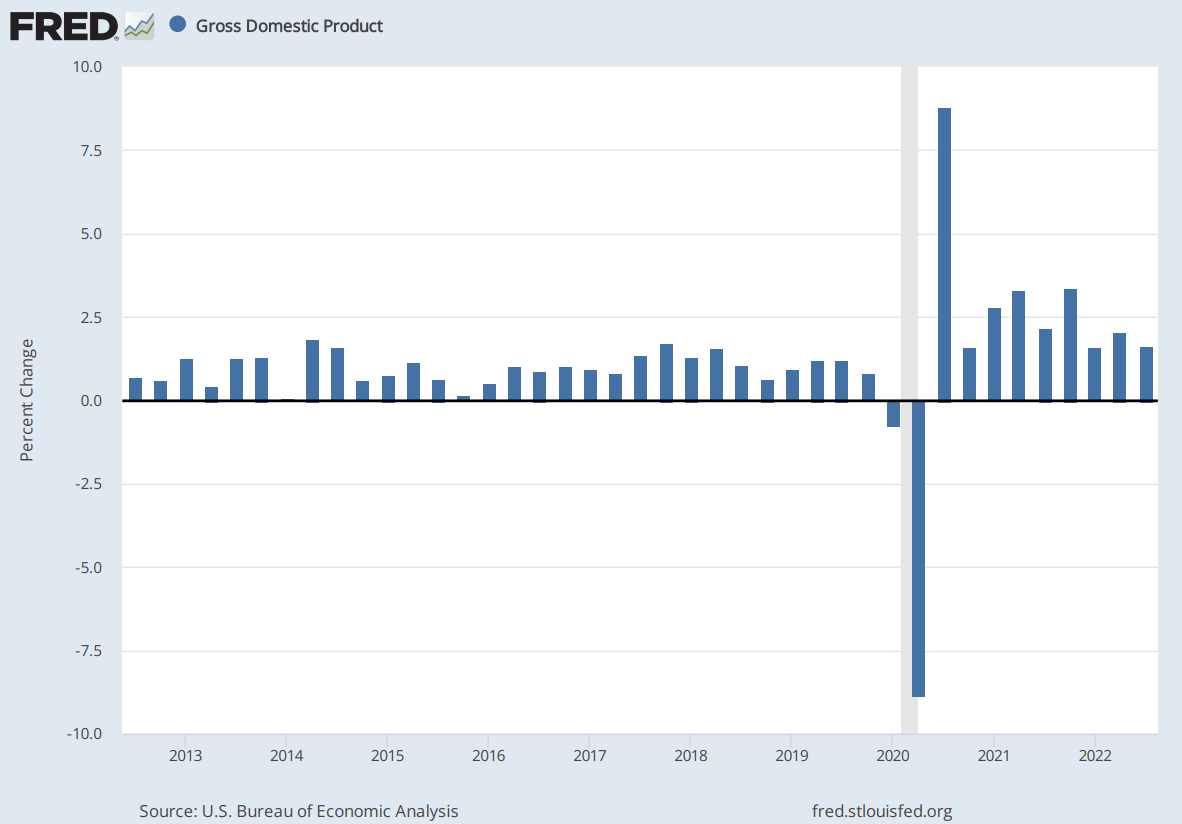

Nominal GDP is still at above-average growth.

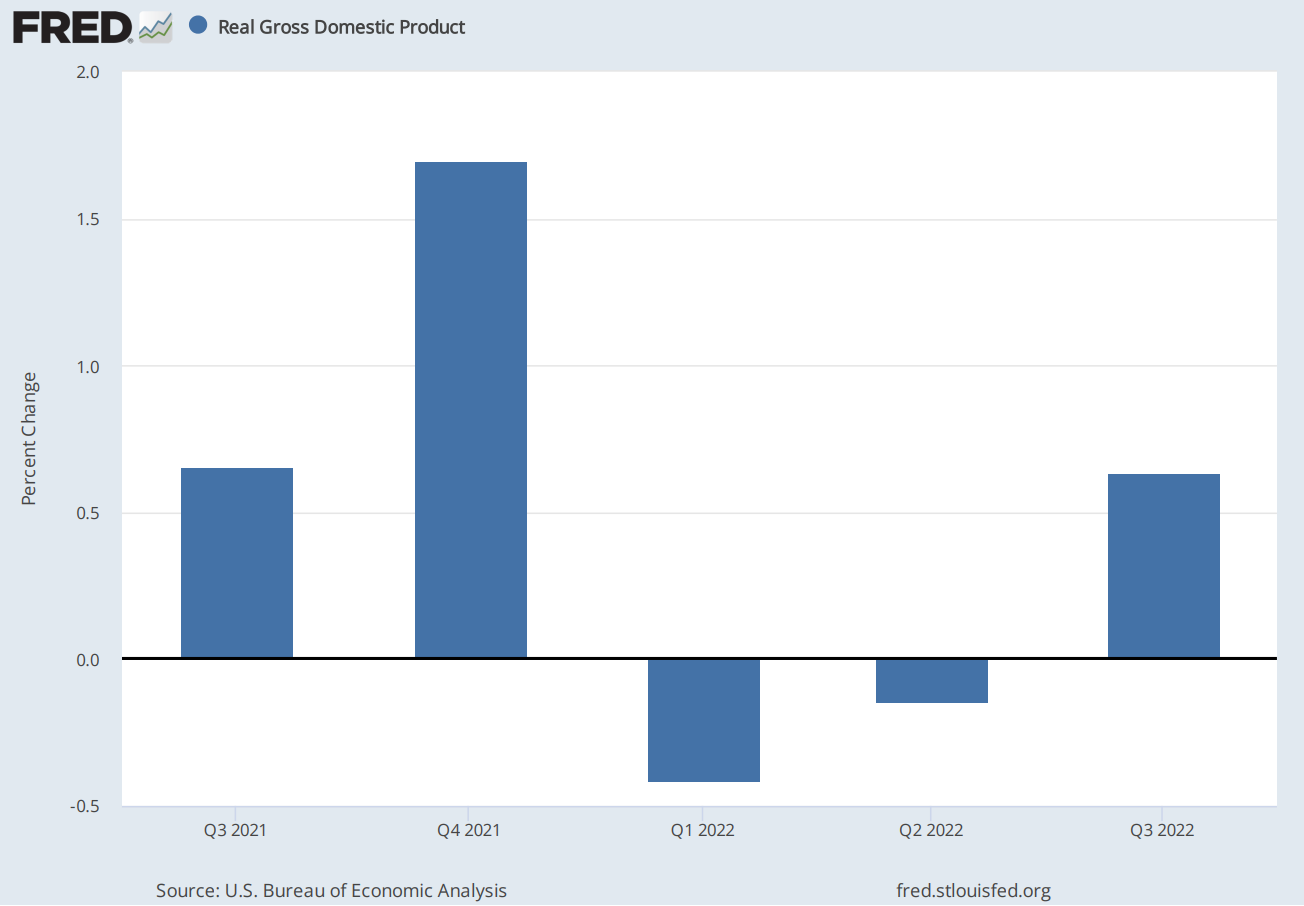

And real GDP growth came in positive for Q3 despite two prior quarters of negative growth.

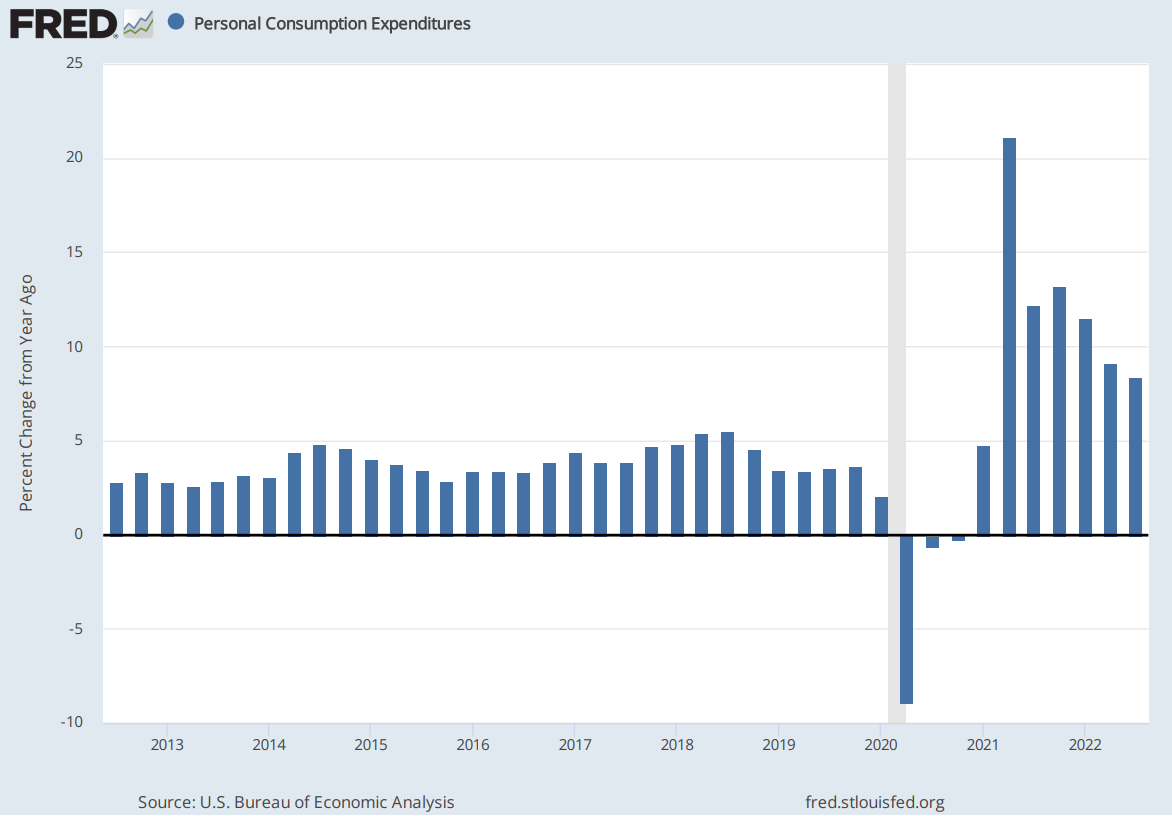

PCE, one of the primary inflation gauges the Fed watches to inform policy decisions, is still very high.

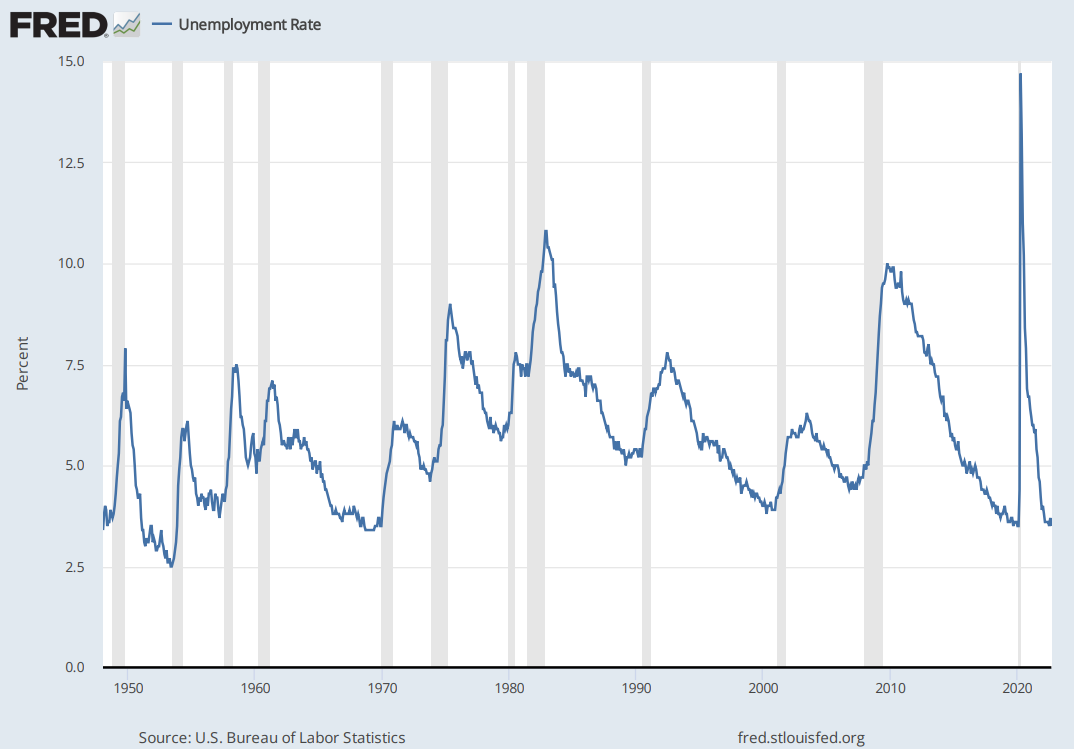

And unemployment is also still very low at 3.5%

High nominal economic growth and inflation combined with low unemployment pressures on the Fed to tighten economic conditions.

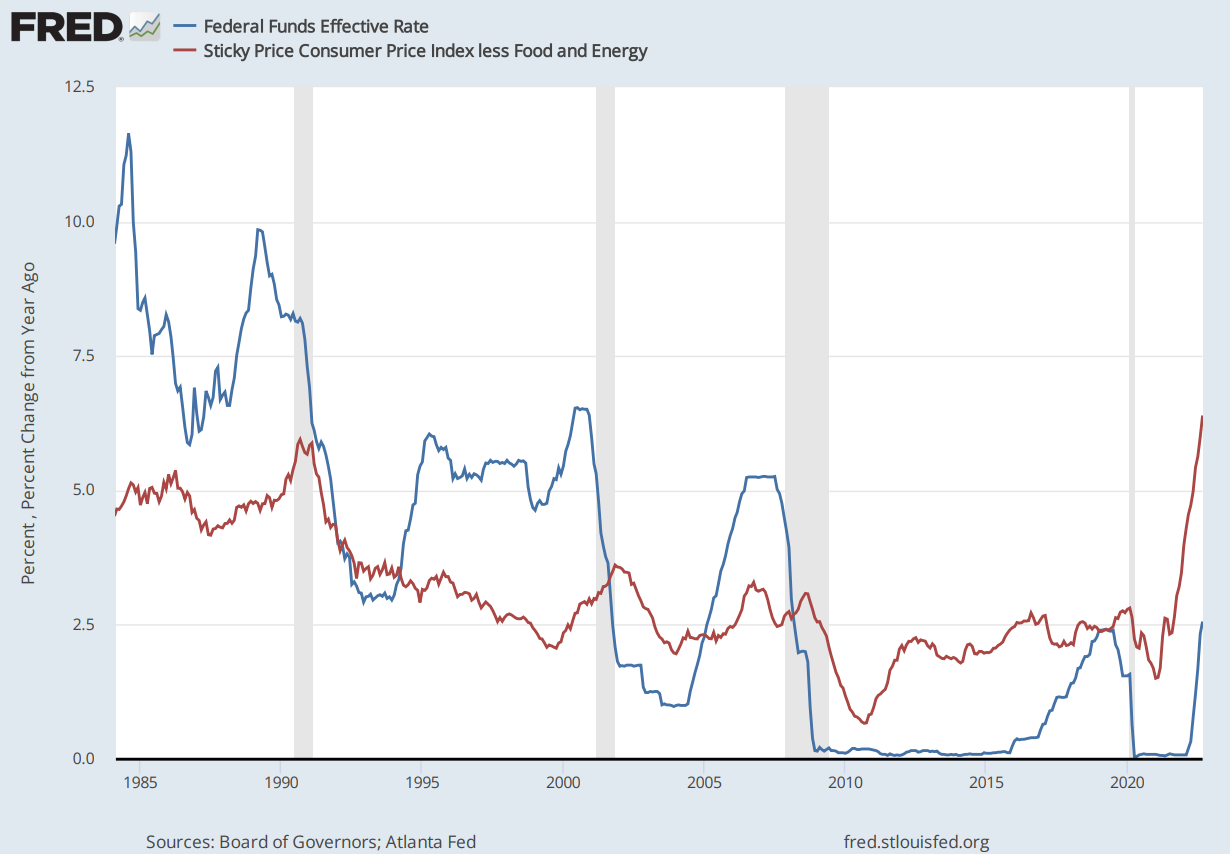

The Fed funds rate, the main interest rate the Fed controls, is still far below the rate of core inflation. In the past, the Fed funds rate was pushed far above the rate of core inflation before the Fed paused rate hikes.

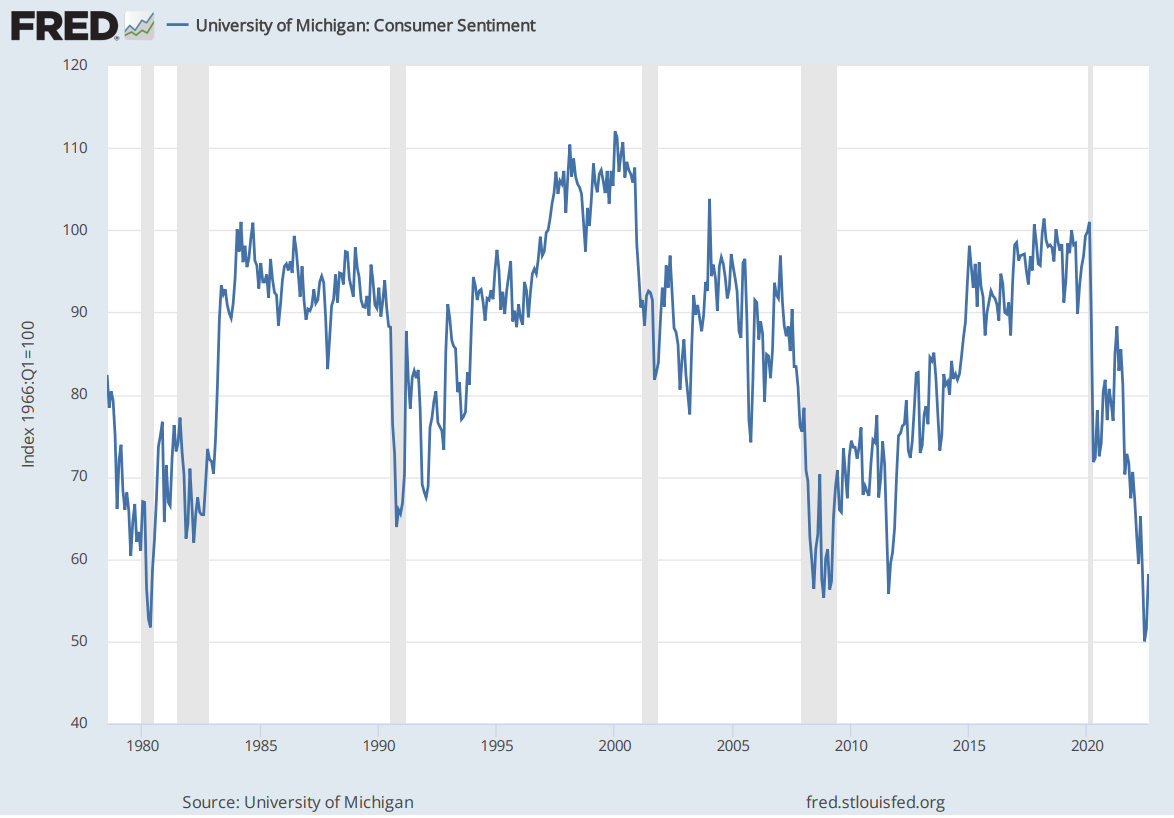

This dynamic is playing out while consumer sentiment is close to historic lows.

What do you think will happen? Will the Fed pause tightening conditions anytime soon?