The correlation between interest rates and the U.S. working-age population

Is the Fed going too far to address a short-term blip in a longer-term downtrend?

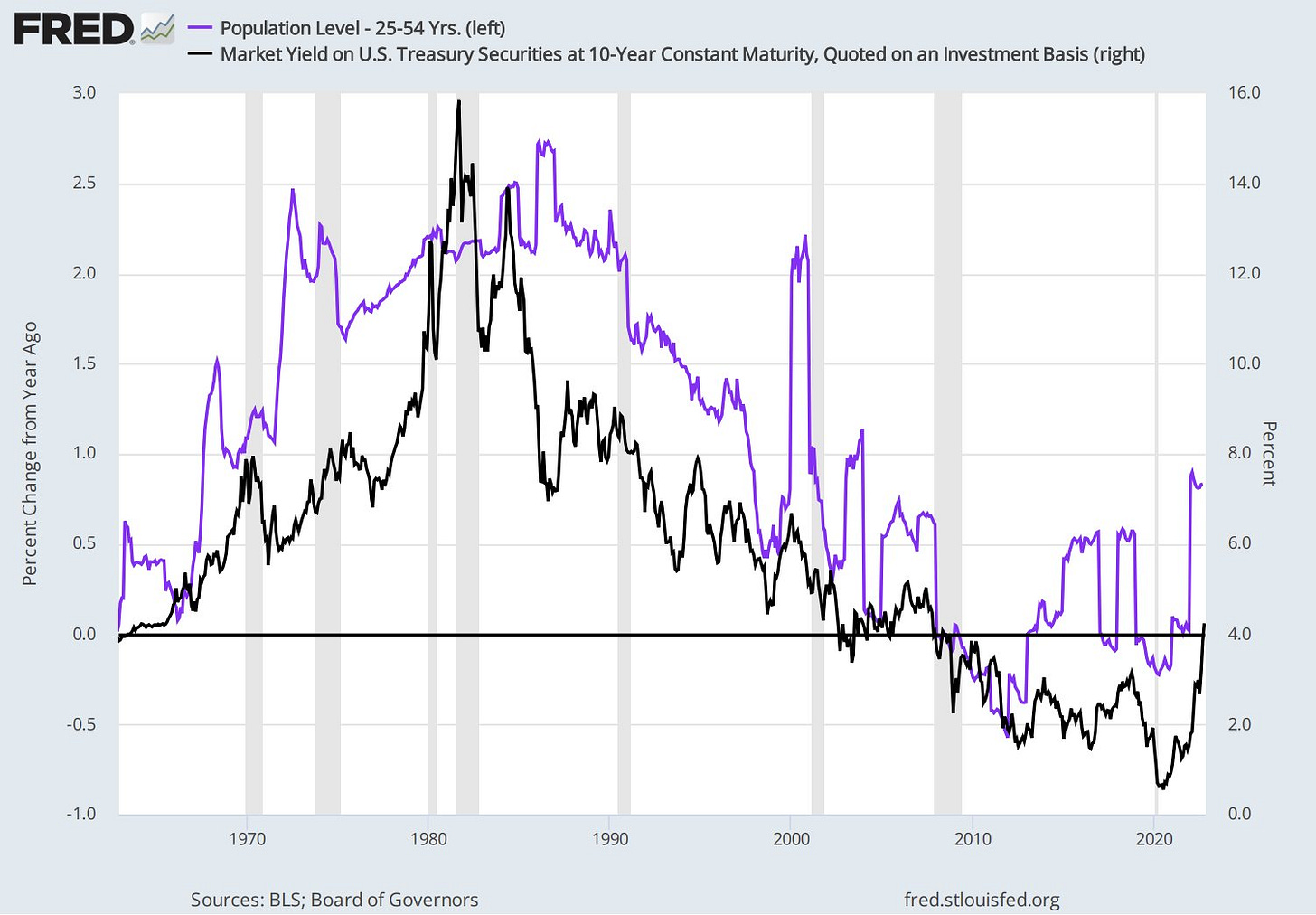

Interest rates have correlated with the rate of change of the U.S. working-age population. Will it continue? Is the correlation spurious?

The chart above shows how the 10-year treasury moves parallel to the YoY change in the U.S.'s 25-54-year-old population. This general age group propels domestic earnings, savings, and, most importantly, spending.

Despite the recent rise in interest rates and the working-age population’s rate of change, the direction is downward.

UN projections show that working-age populations will most likely decline as a percentage of the population. And the total population of 20-64 year olds will increase slower than previous decades.

In its current form, the global economy was built on secular declines in the cost of capital. As the Fed continues to tighten monetary policy, the risks of going too far in the middle of a secular downward trend is worrisome.

When will the Fed pivot? Will they break the global financial system before they change course?