There are many indications the economy is on the precipice of a significant decline. Ironically, the most glaring sign of a coming recession is that the economy is still too hot.

In this article, I examine macroeconomic data to understand where we are and where we could be headed. I hope it inspires further research and analysis.

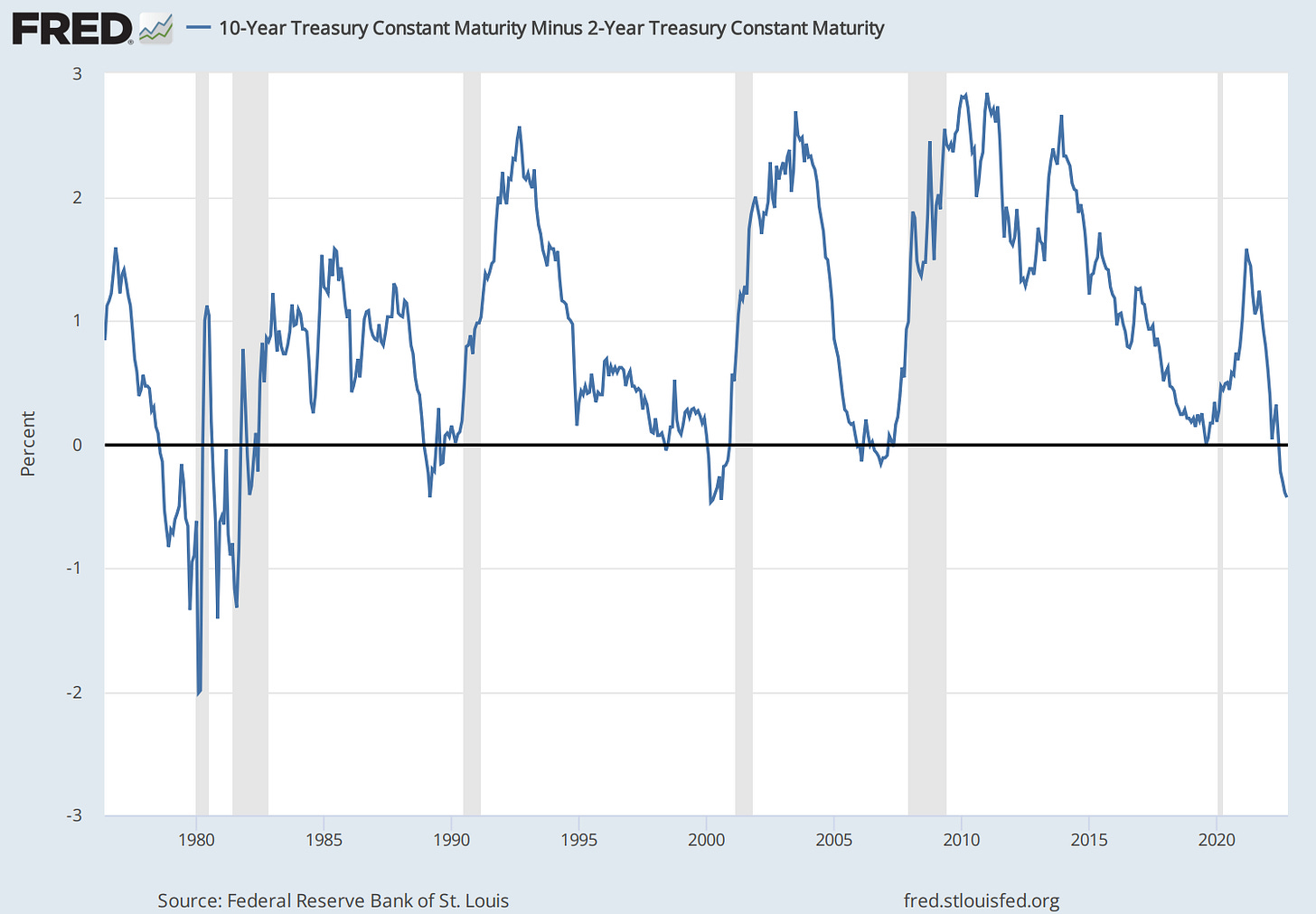

Yield curve inversions

An inverted yield curve preceded every U.S. recession in modern history, and it's currently flashing a warning sign (the shaded grey area in the graph shows recessions).

A yield curve shows the slope of interest rates across different maturities. When market commentators mention "the yield curve," they often refer to the 10-year treasury minus the 2-year treasury. When the yield curve inverts, a shorter duration offers a higher yield.

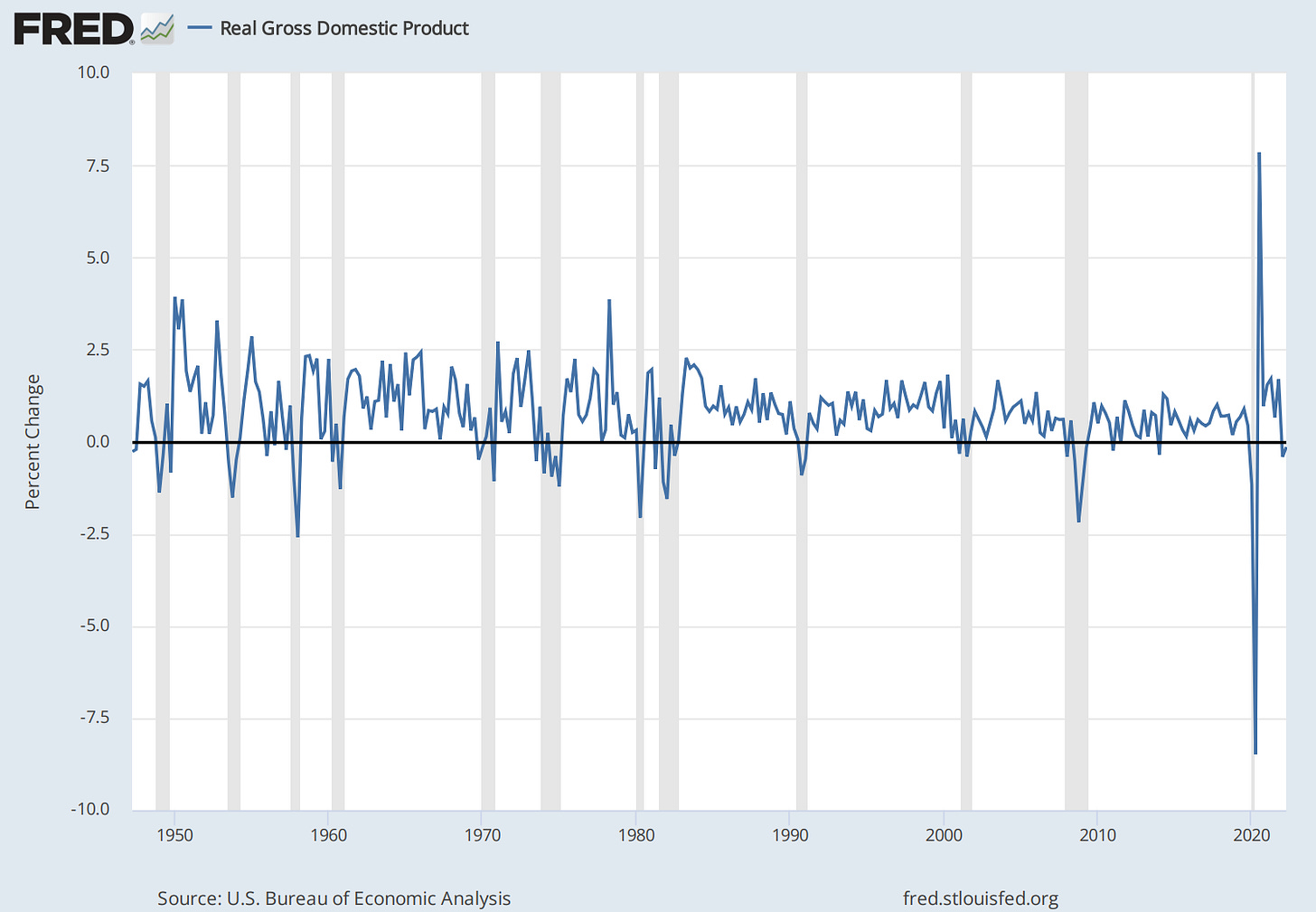

Negative Real Gross Domestic Product

Every recession saw negative quarter-over-quarter real GDP growth, but there have been times when negative quarterly growth didn't amount to a recession. Two-quarters of negative growth nearly always means the economy is in a recession, and Q1 and Q2 of 2022 were both negative as of writing.

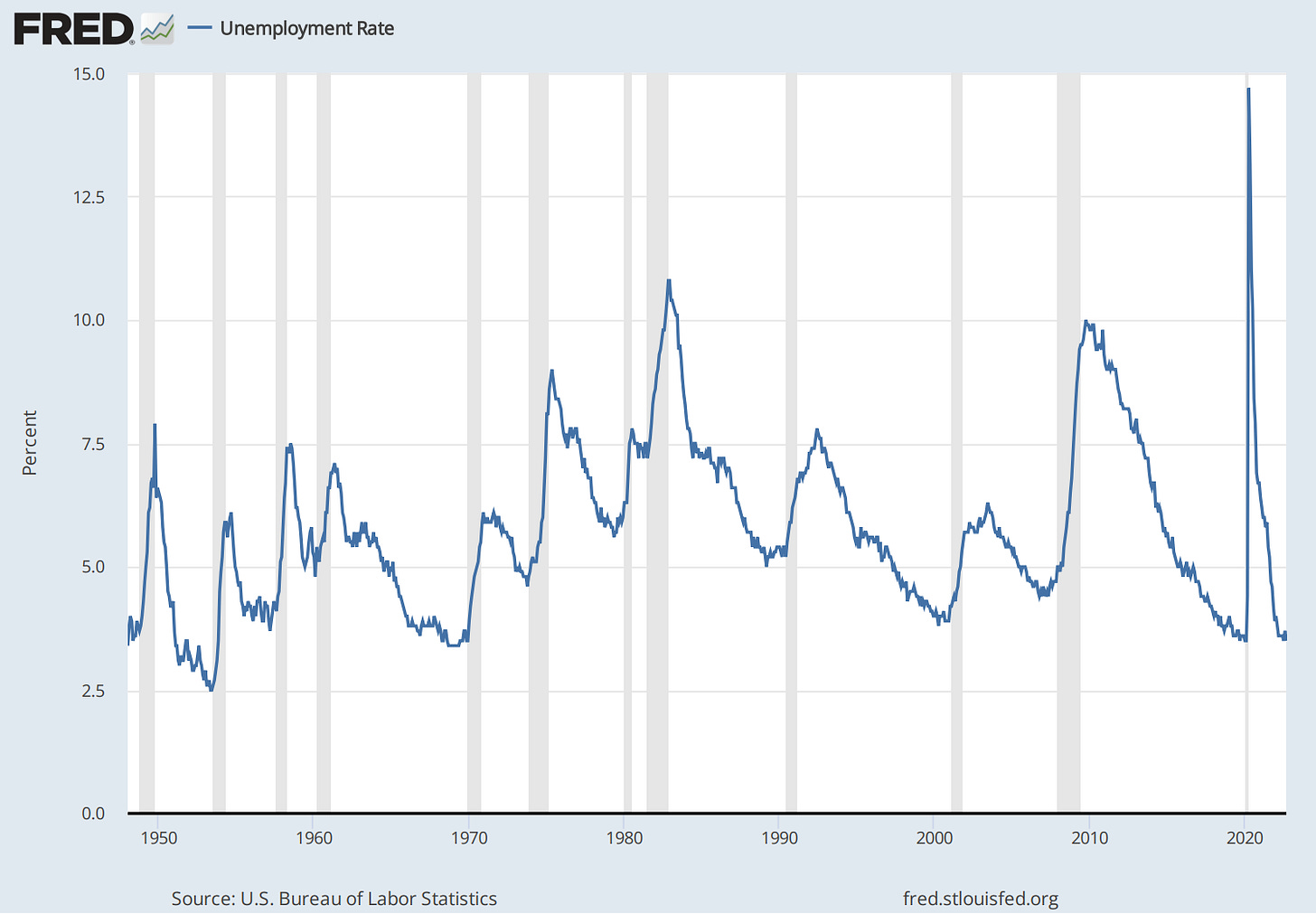

Unemployment and wages

Unemployment spikes into and throughout a recession. Although somewhat of a tautology, relative lows in unemployment proceed recessions. Unemployment was near or above its current level before every recession since the 1950s.

Housing affordability

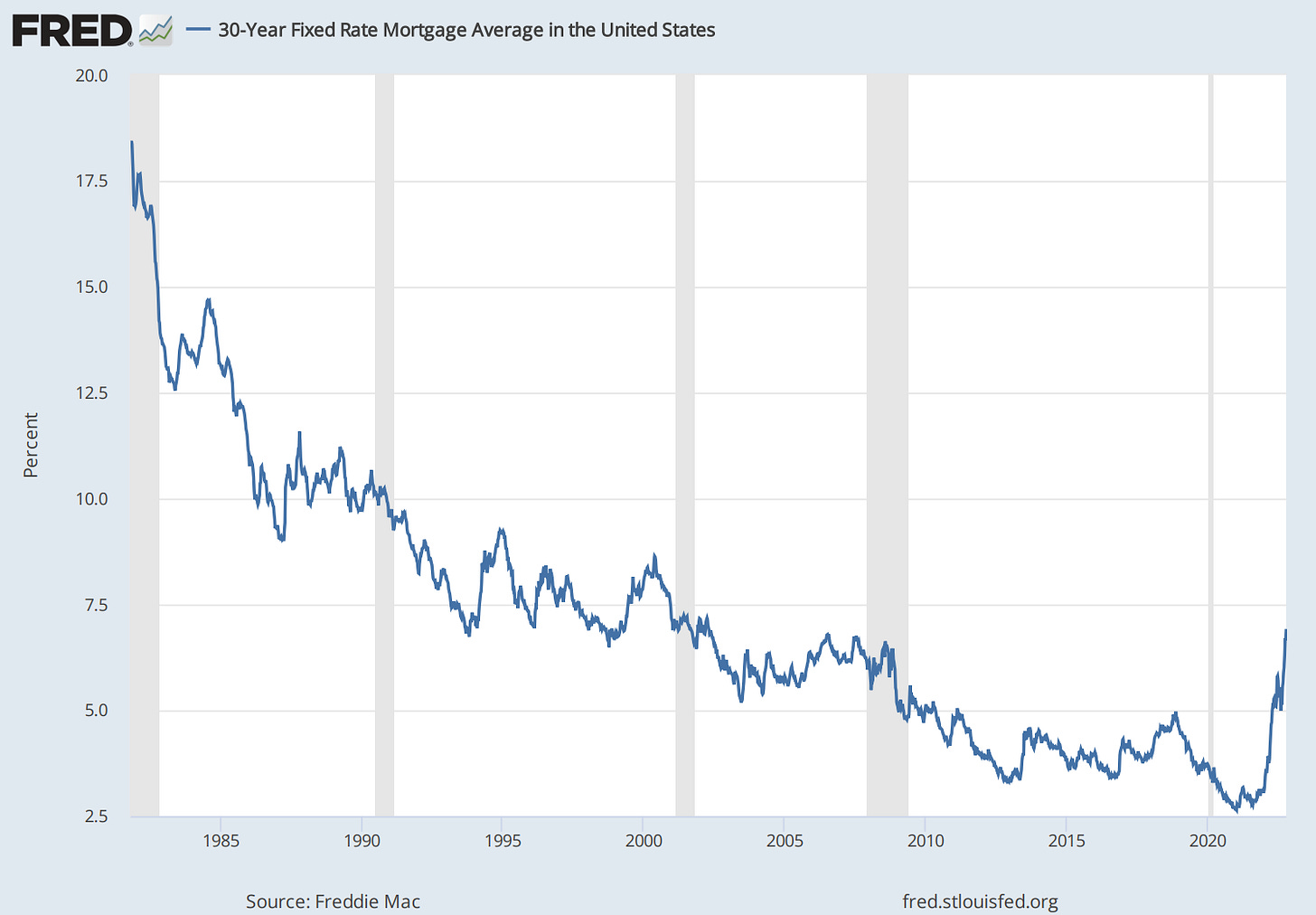

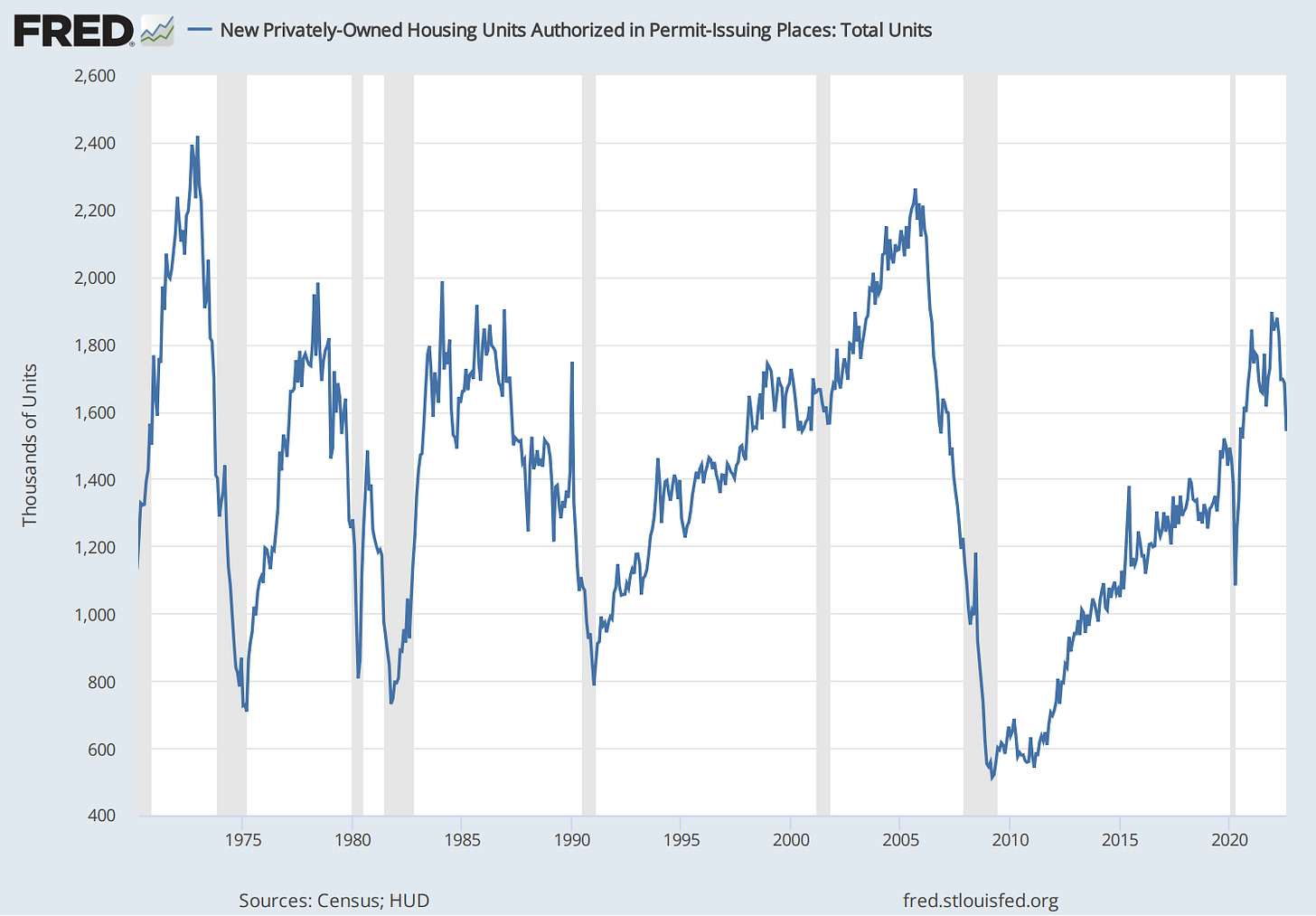

There's been a dramatic slowdown in the housing market in recent quarters driven by high prices and mortgage rates.

The housing market informs the direction of the economy. Consumer confidence builds when the housing market is strong and the wealth effect takes hold. The consumer can use their house as an ATM, exchanging equity for cash to finance their life. When there's a housing downturn, homeowners feel less wealthy and have fewer refinance options.

Financing the purchase of a house with a mortgage is a form of long-duration leverage, and a mortgage is one of the most significant ways "money" comes into existence.

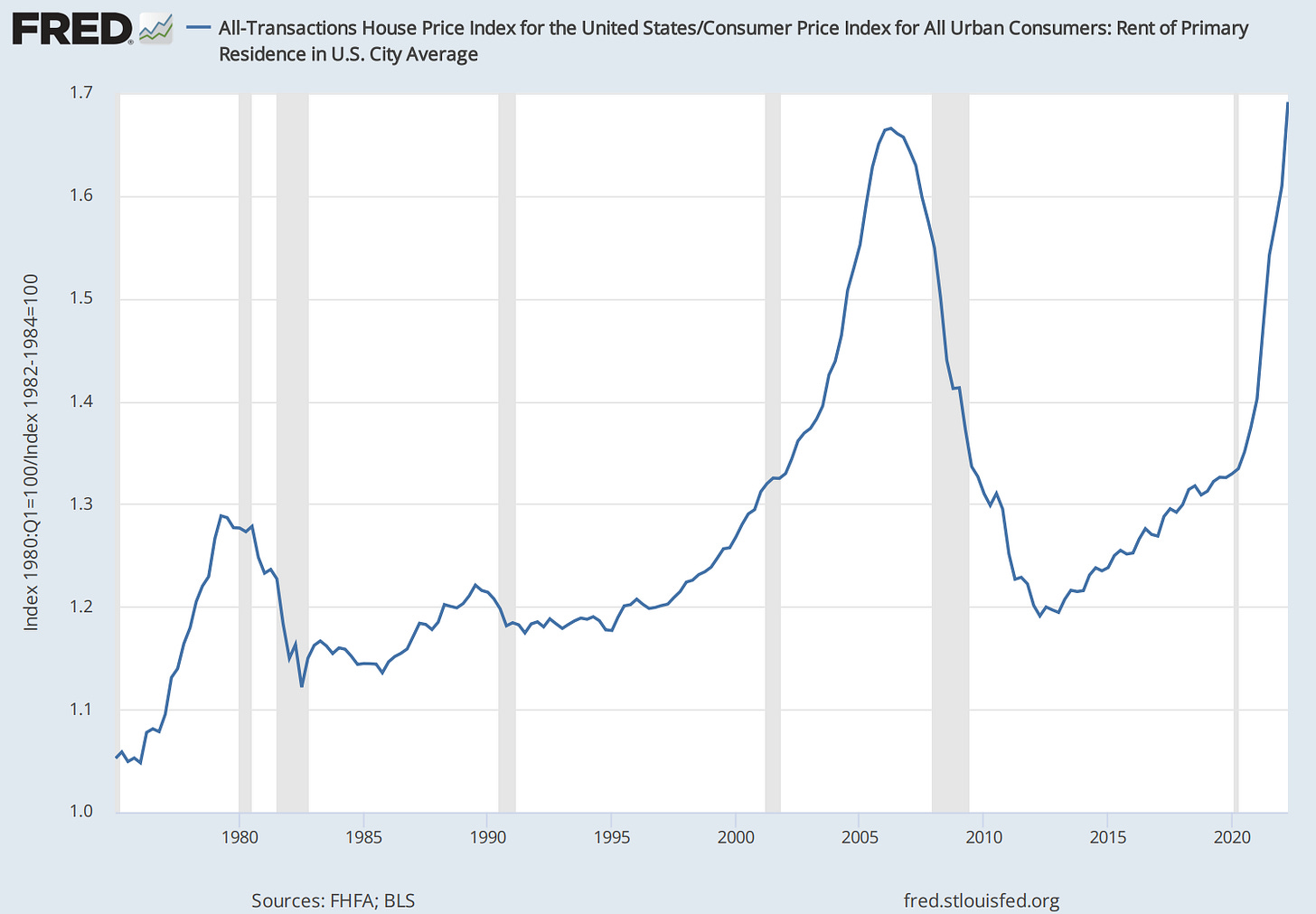

I divided the U.S. house price index by rent prices in the chart above. I think this chart provides a window into the relative value calculation consumers make when determining whether to buy a house.

This ratio is approaching levels not seen since the housing bubble's peak before the Global Financial Crisis. Will history repeat? Who knows, but it shows how unaffordable it's becoming to buy property.

Also, a downturn in housing permits and starts can point to an impending recession—something to keep your eye on as mortgage rates spike.

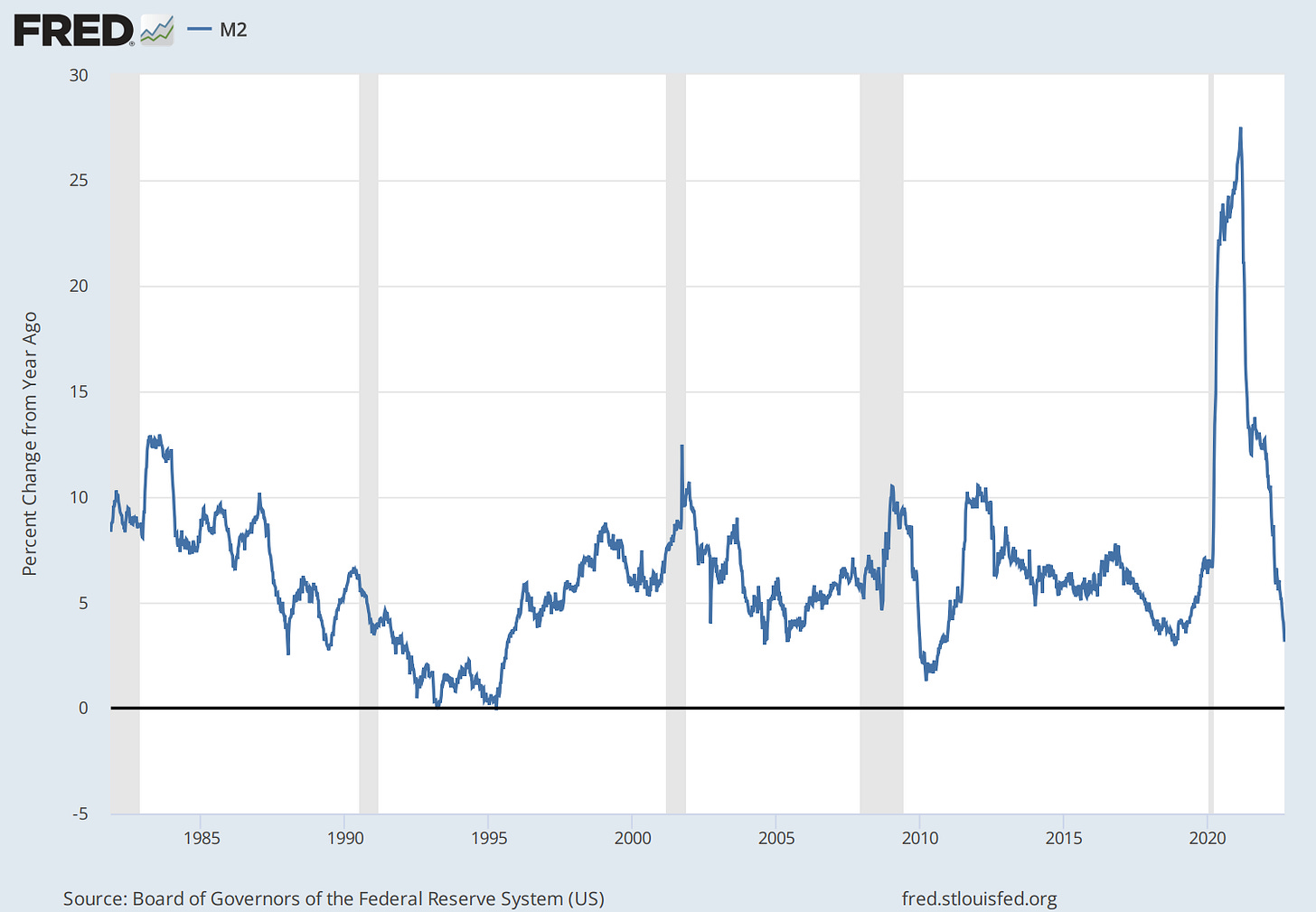

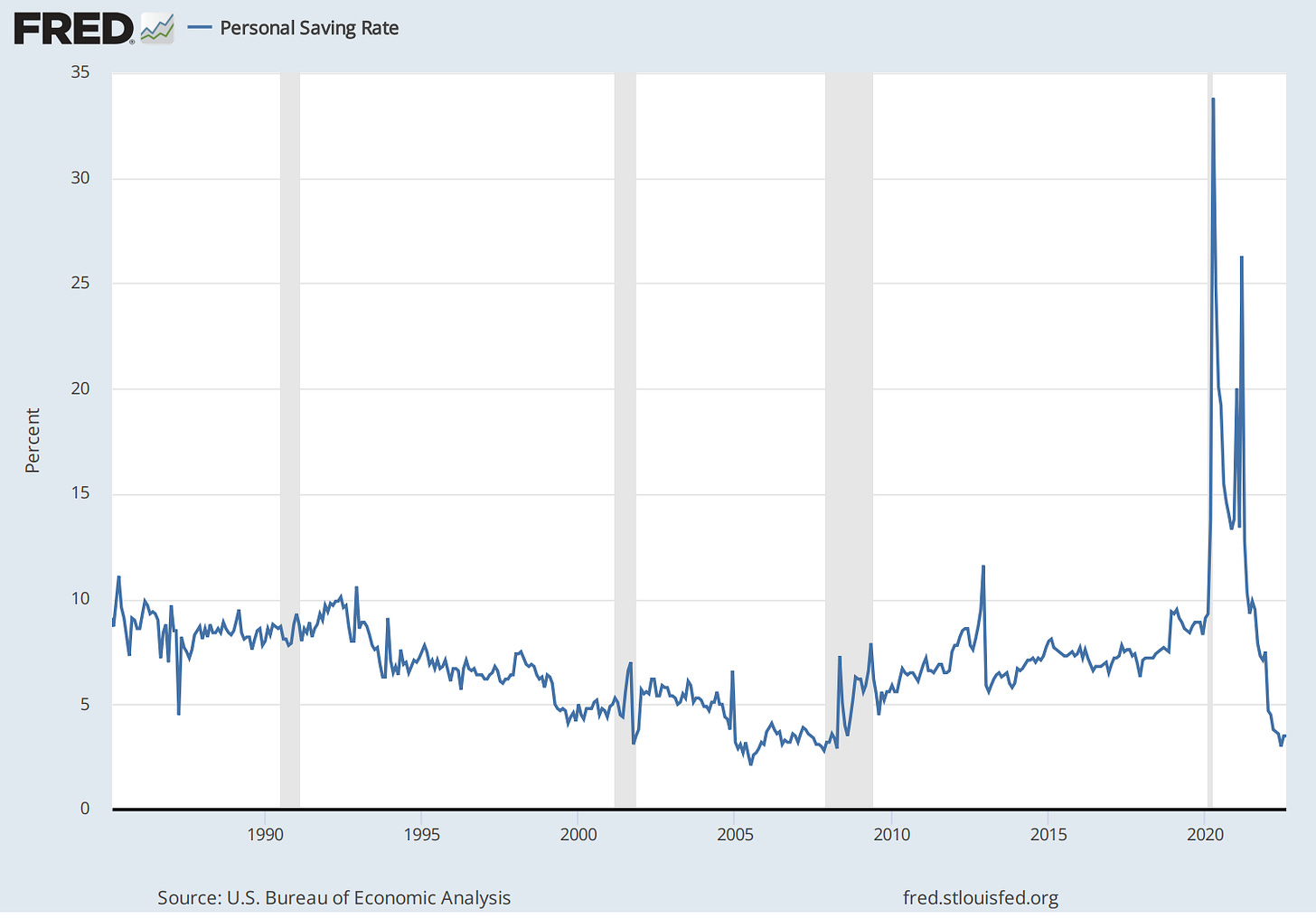

Money growth

M2, the measure of broad money (cash and cash-like equivalents), historically spikes on a YoY rate of change basis around a recession.

The personal savings rate also went through a dramatic swing and is now at its lowest point in a decade. Will consumers still have a savings glut in coming quarters?

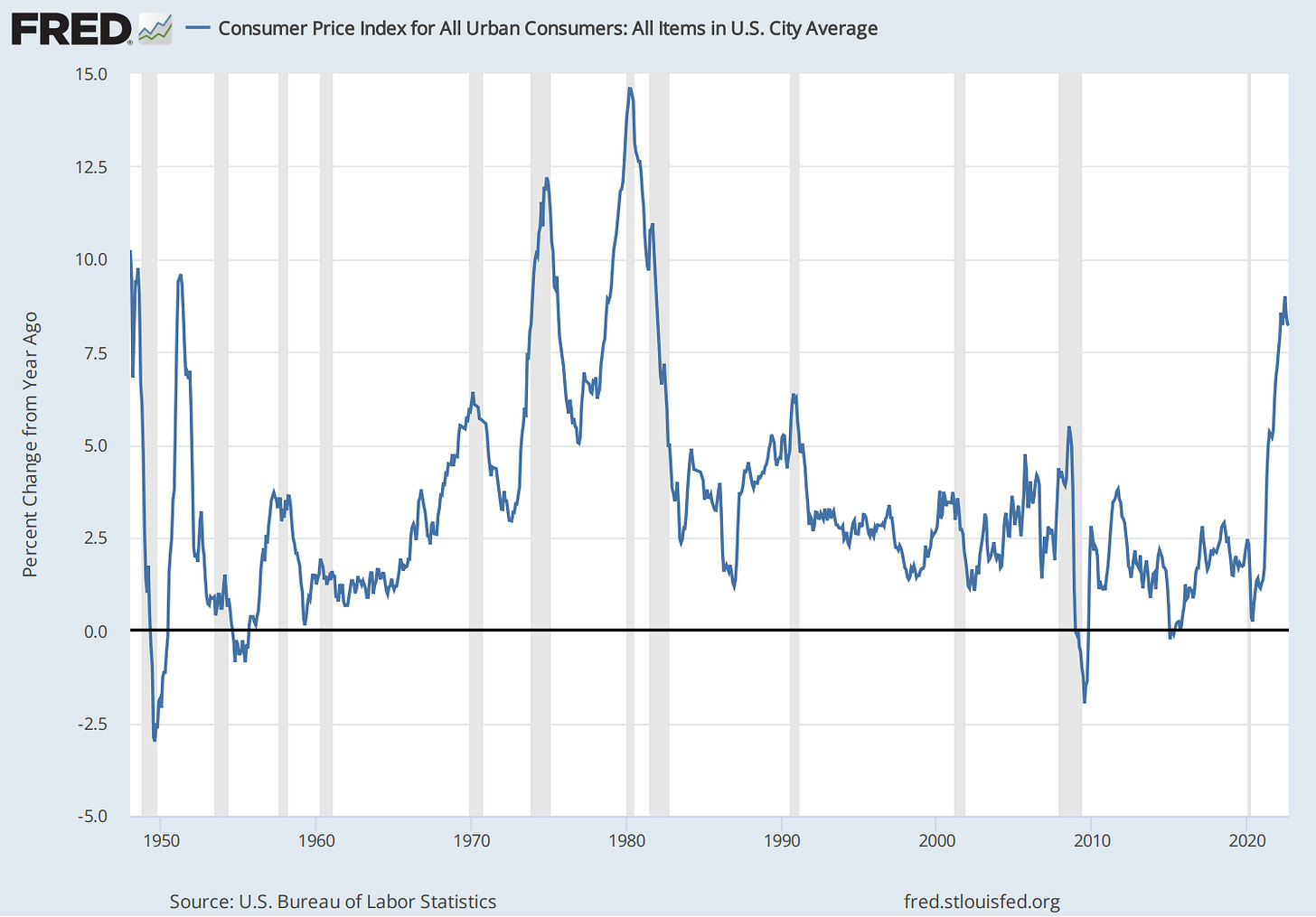

Inflation and disinflationary headwinds

Inflation spikes have correlated with recessions in the past and inflation is hitting its highest levels in my lifetime.

The Consumer Price Index (CPI) measures goods and services, including housing, food and beverages, transportation, medical care, recreation, education, apparel, and other goods and services.

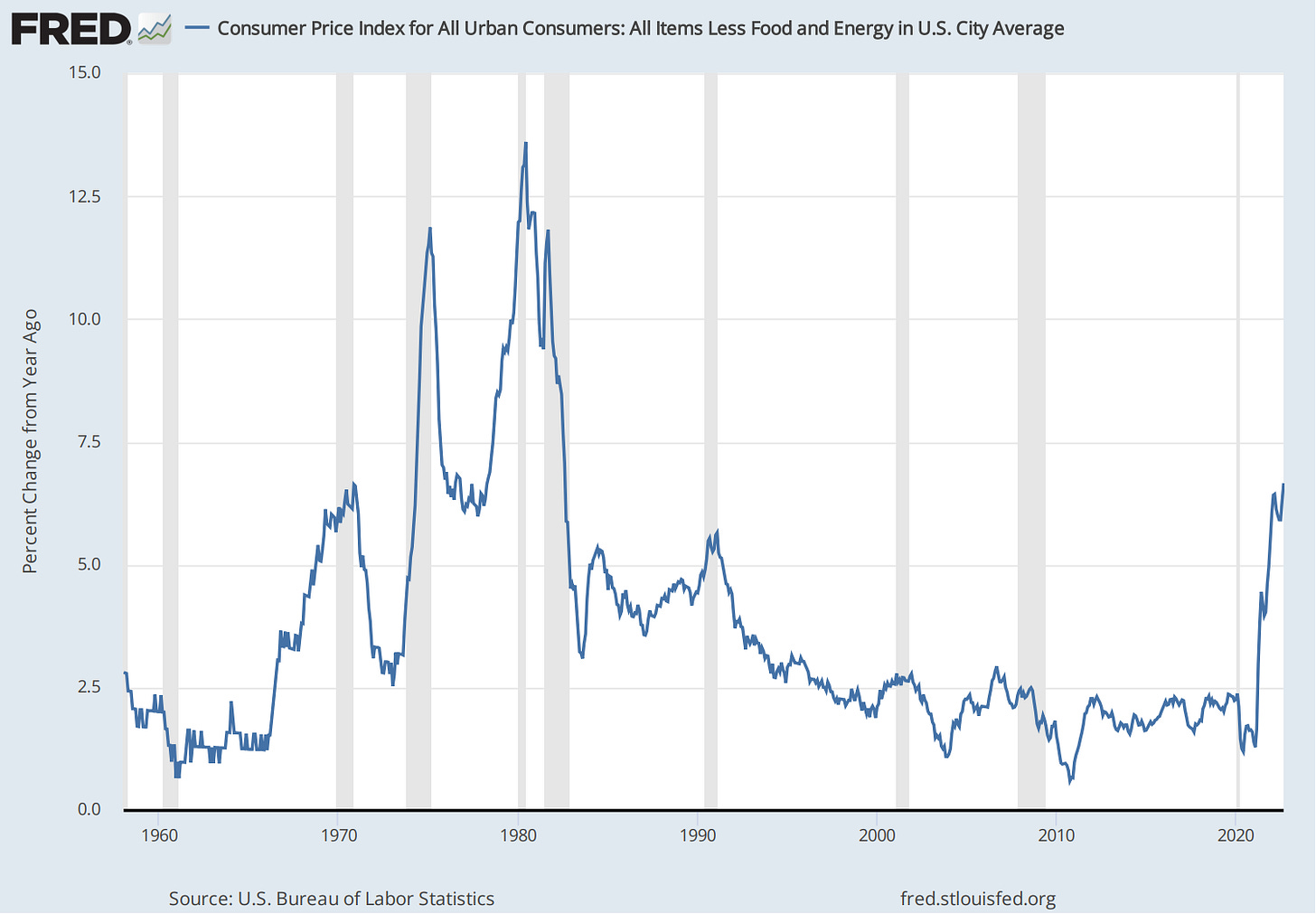

Core CPI is arguably a better gauge of inflation because it excludes food and energy, which are more volatile than the other components of CPI. Core inflation surprised analysts in recent months as it continues to increase YoY.

Why inflation matters

High inflation and low unemployment pressure the Fed to tighten financial conditions. Tighter monetary policy often leads to economic slowdowns and recessions.

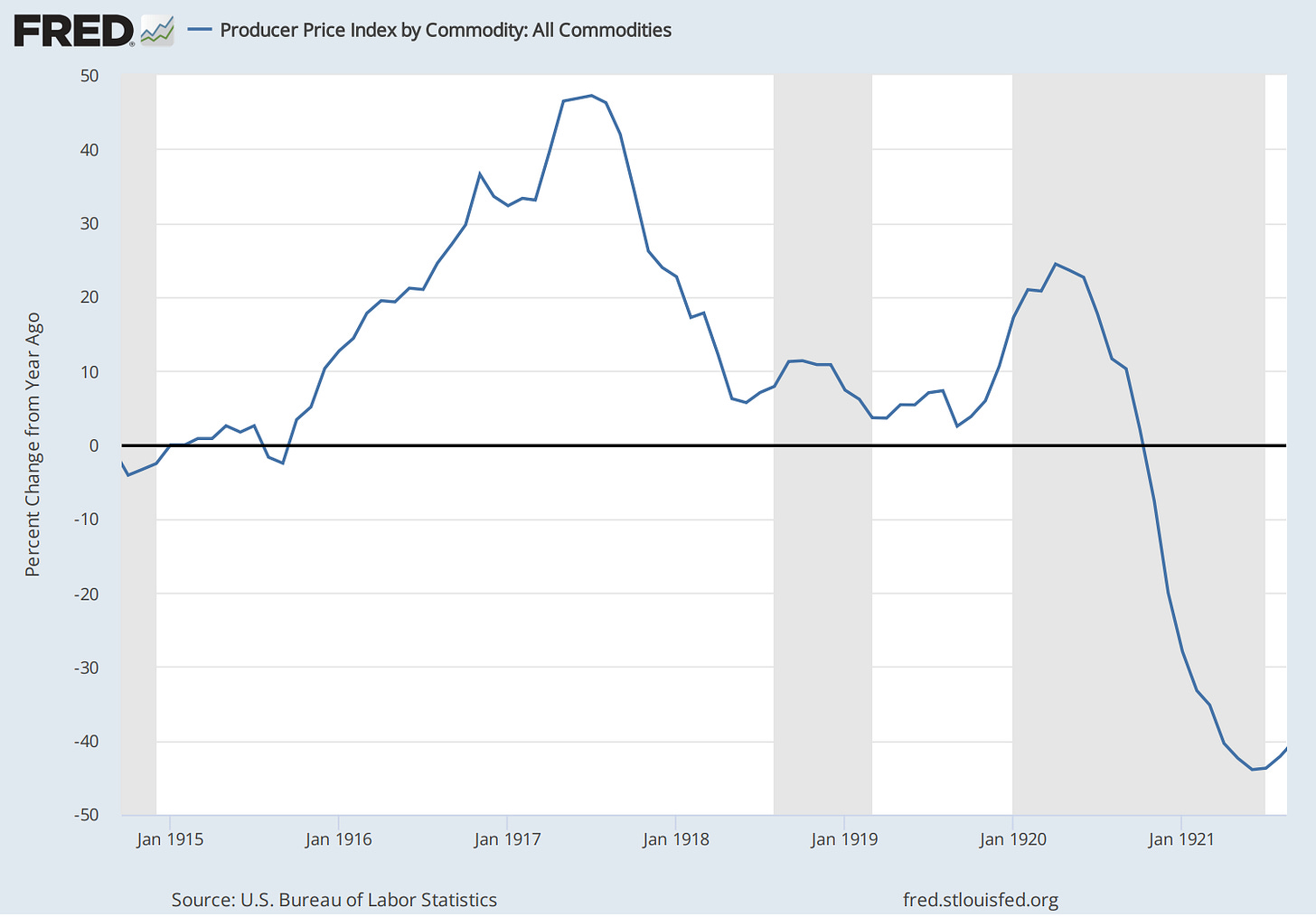

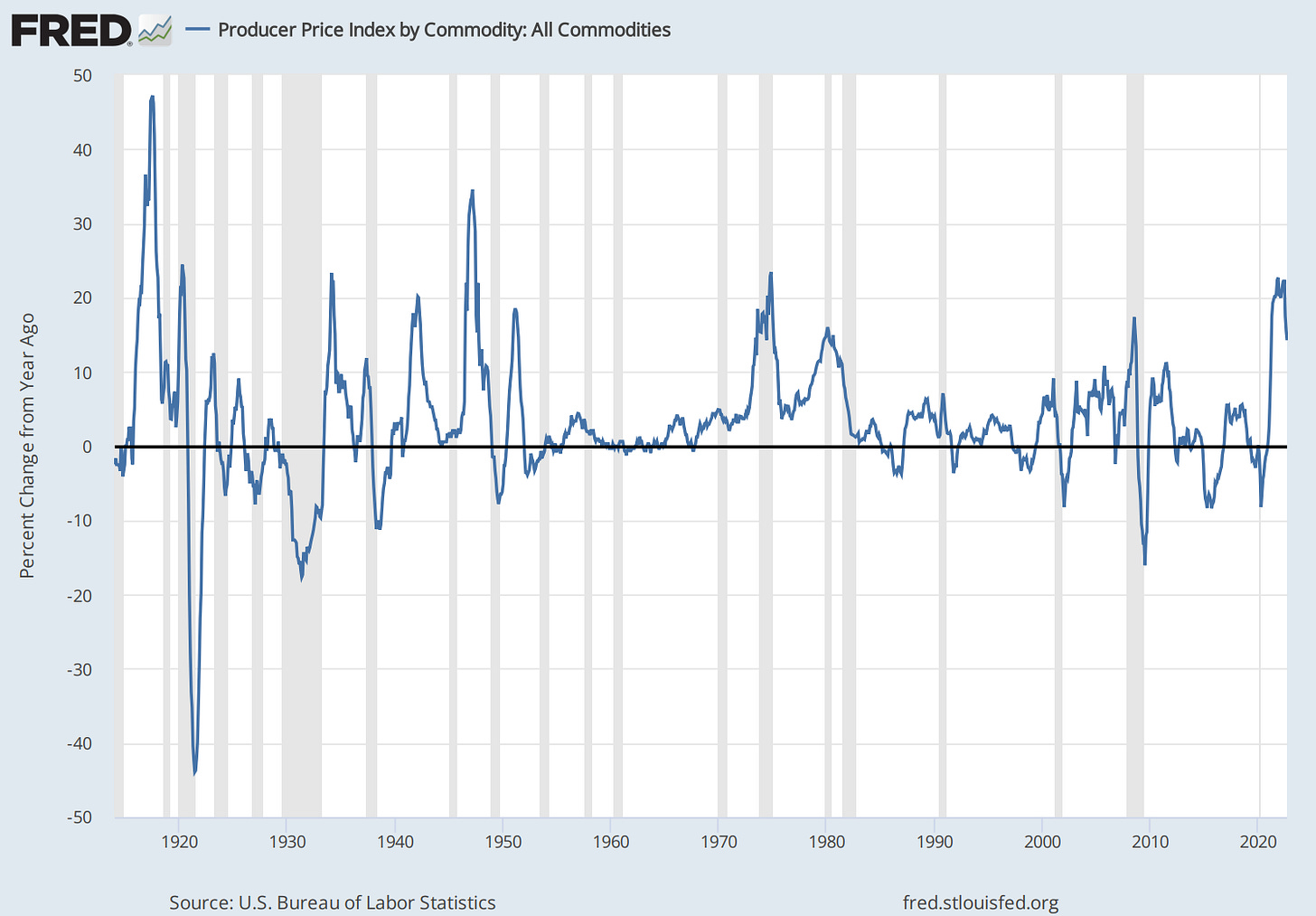

The Producer Price Index (PPI) is another gauge of inflation. It measures the price U.S. producers get paid for their goods and services.

The PPI's most dramatic monthly YoY swings occurred from 1914-1921. I find this time informative because it encapsulated the outbreak of WWI, a global pandemic, and the "forgotten depression."Although the economy is vastly different than it was during this time, I can't help but wonder if history will rhyme as we witness a pandemic and war 100 years later.

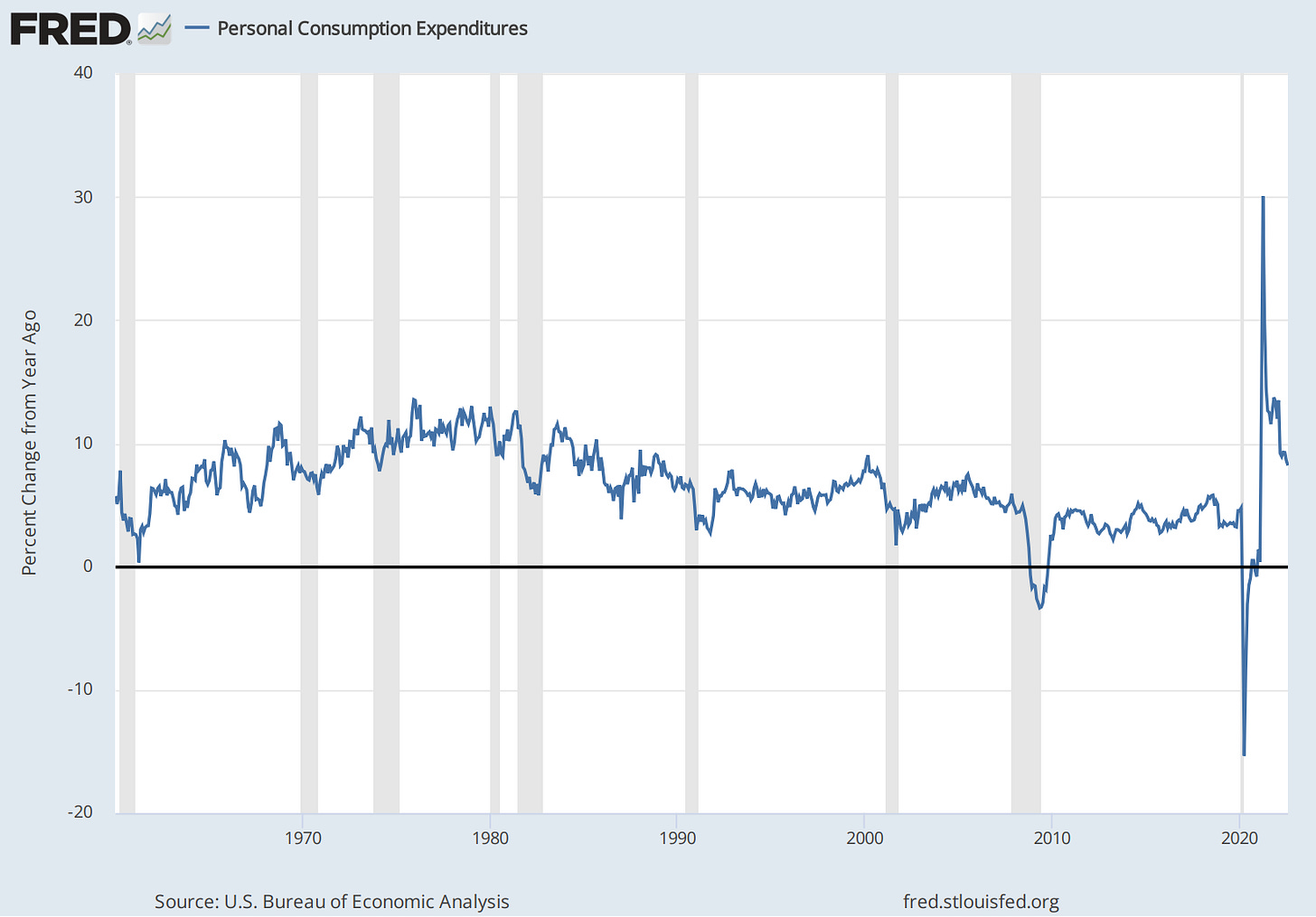

Personal Consumption Expenditures (PCE) is another measure of inflation. PCE is different from the CPI because it is sourced from businesses instead of consumers and its component weightings are different.

PCE hit its lowest and highest monthly YoY change between April 2020 and April 2021 and remains very high.

The Fed chair, Jerome H. Powell, recently discussed how the Fed views PCE as a better measure of CPI. The change in PCE will inform Fed policy. Something to watch…

So are we headed for a recession? Are we already in one?

Central banks worldwide implemented massive policy interventions during the 2020 crisis to fill the income holes left by locking down the world economy. When economies across the world reopened with consumers flush with cash, inflation spiked to 40-year highs. However, supply chain bottlenecks constrained supply.

A war broke out, further choking the supply of the most basic input into the economy—oil. On top of that, "the world's factory," China is still in lockdown. These supply/demand mismatches force central banks worldwide to tighten economic conditions.

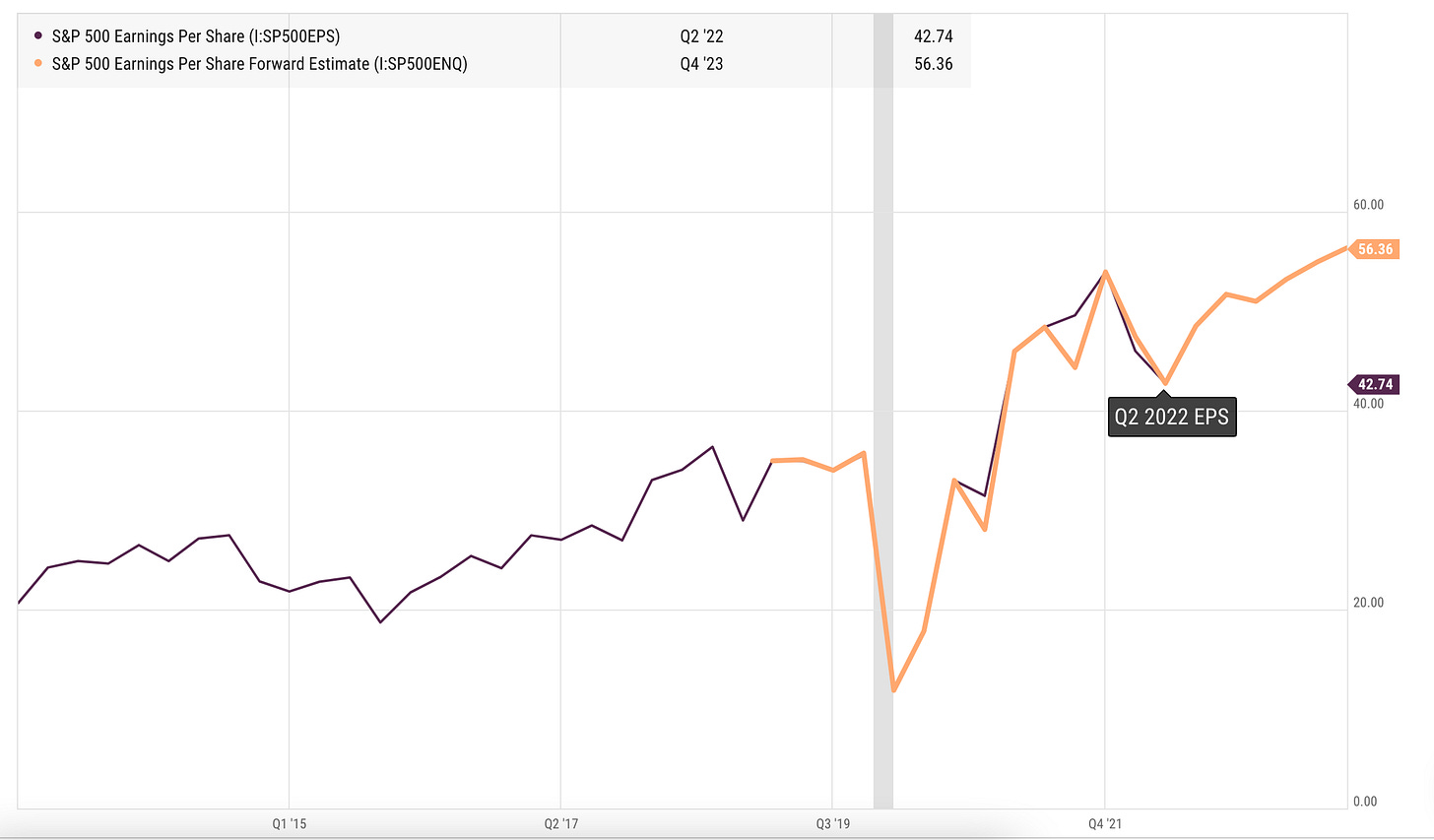

Also, I think the market’s forward earnings estimates are too optimistic. Slowing money growth and higher interest rates will negatively impact consumer demand and corporate earnings in coming quarters (I could be wrong). Lower earnings will lead to layoffs and further decreases in demand. At the same time, supply chains haven't recovered. Central bankers could be killing future supply growth hoping to cool demand.

However, if inflation begins to come down and central banks start providing liquidity to markets again, perhaps global economies will experience a "soft landing," but I doubt it.

I remain agnostic on when the U.S. economy enters an offical recession (or if we are in one now), but I hope this analysis provides a jumping-off point for your research.

Whatever happens, it’s going to be historic. Take care of yourself ❤︎

I appreciate your feedback and thoughts on this topic. If you found this article interesting, consider liking and subscribing to motivate me to write more content like this article.

*Also, keep in mind I might be wrong in my analysis. Do your own research.