Exploring China's declining ownership of U.S. debt and what it means for America

Has China's economic power peaked?

The relationship between China's production and U.S. consumption might be at a pivot point as global tensions rise, China's working-age population falls, and debt slows future growth.

After Nixon ended the gold standard and initiated a trade deal with China, China experienced the fastest economic growth and industrialization the world had ever seen.

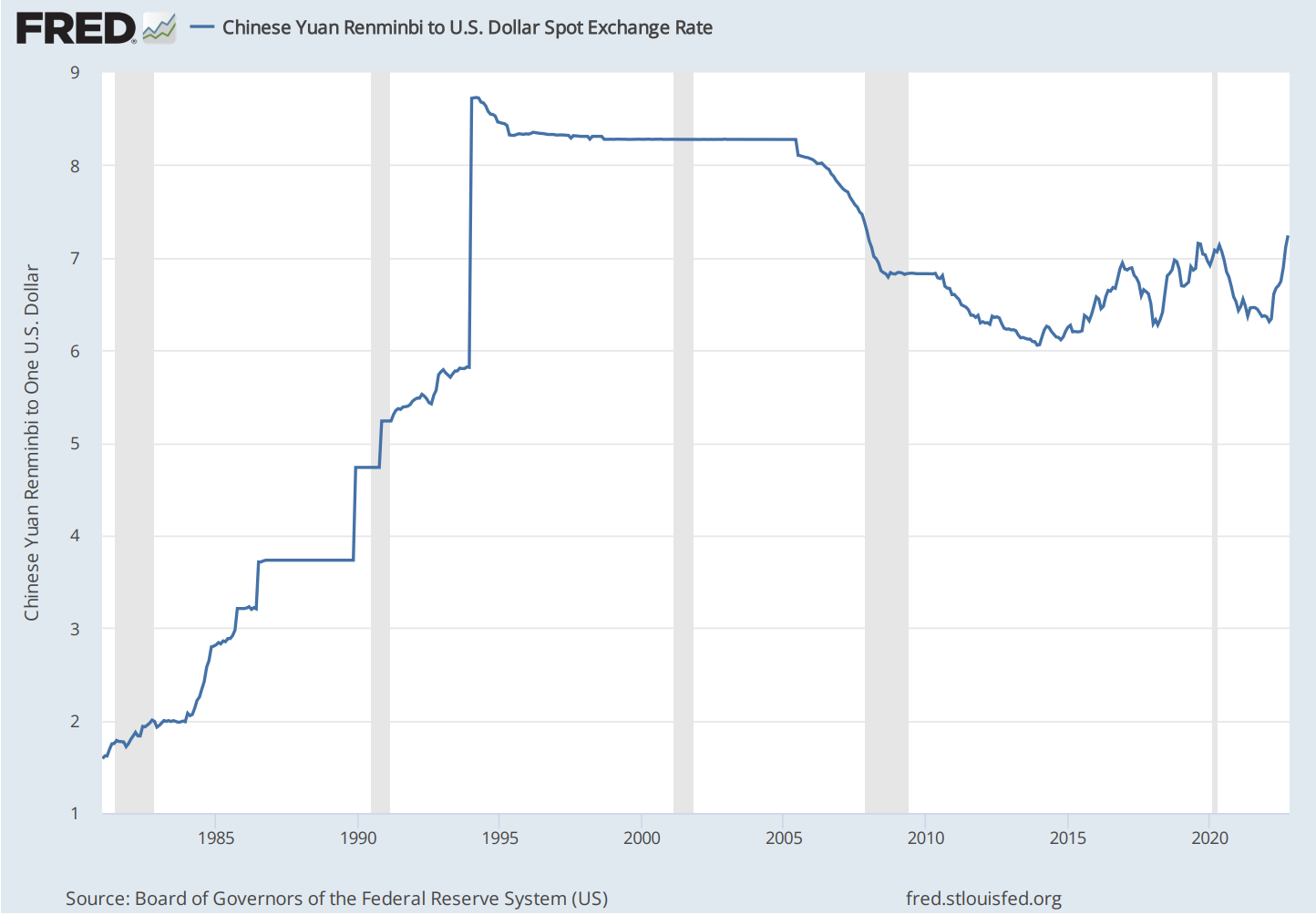

China did this through a repeating cycle of printing its currency, converting it to U.S. dollars, buying raw commodities, converting these commodities into domestic infrastructure and finished goods, selling its output to the world, and recycling the proceeds into U.S. debt.

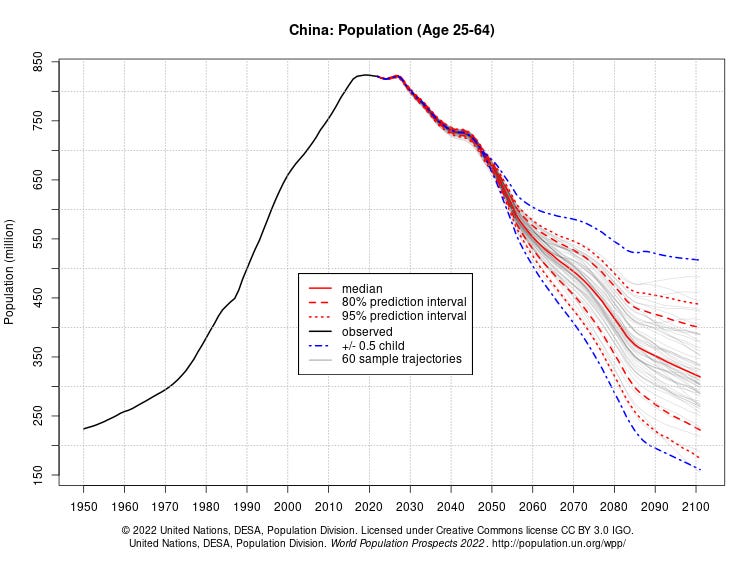

It occurred as China's "demographic dividend" increased dramatically.

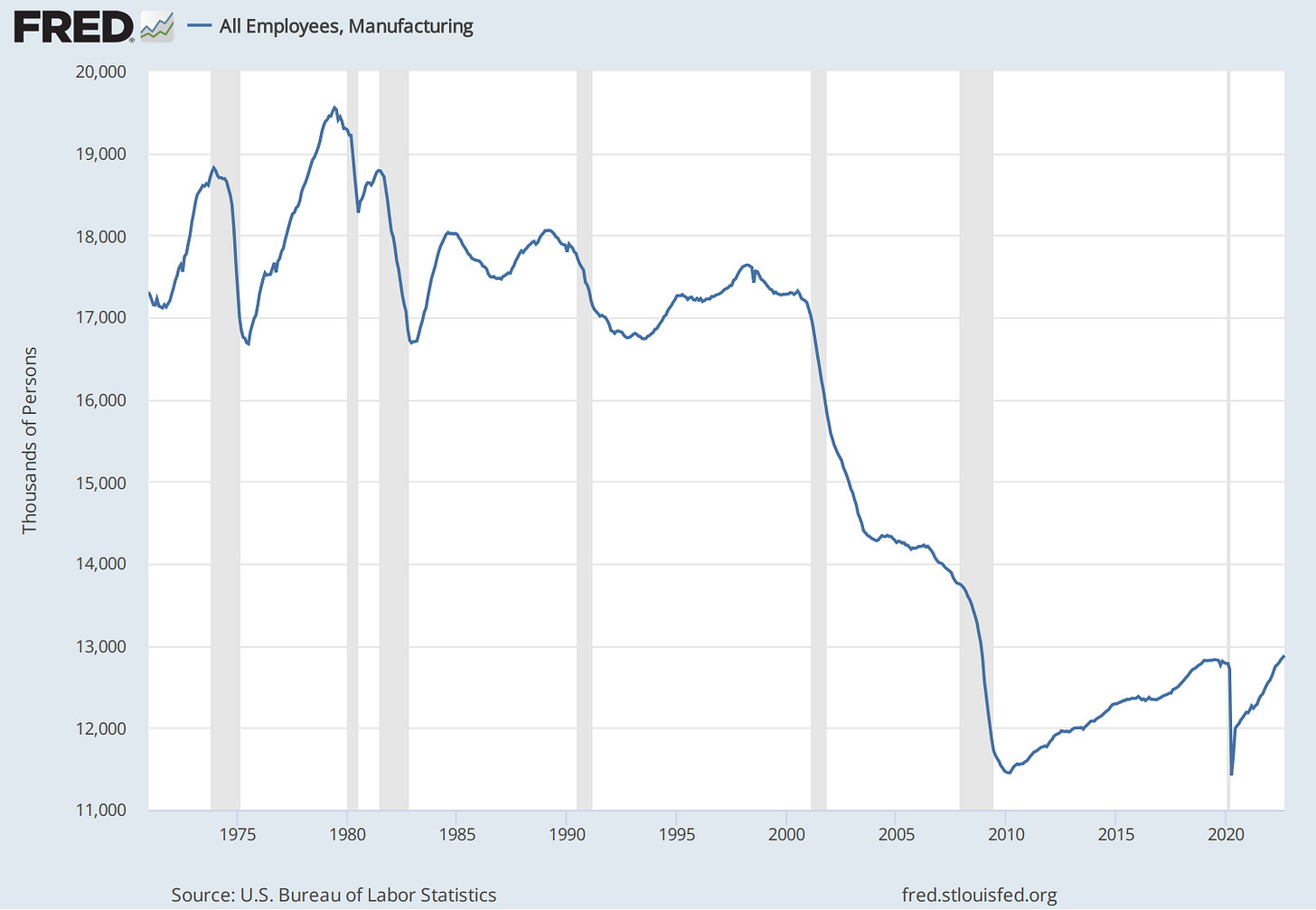

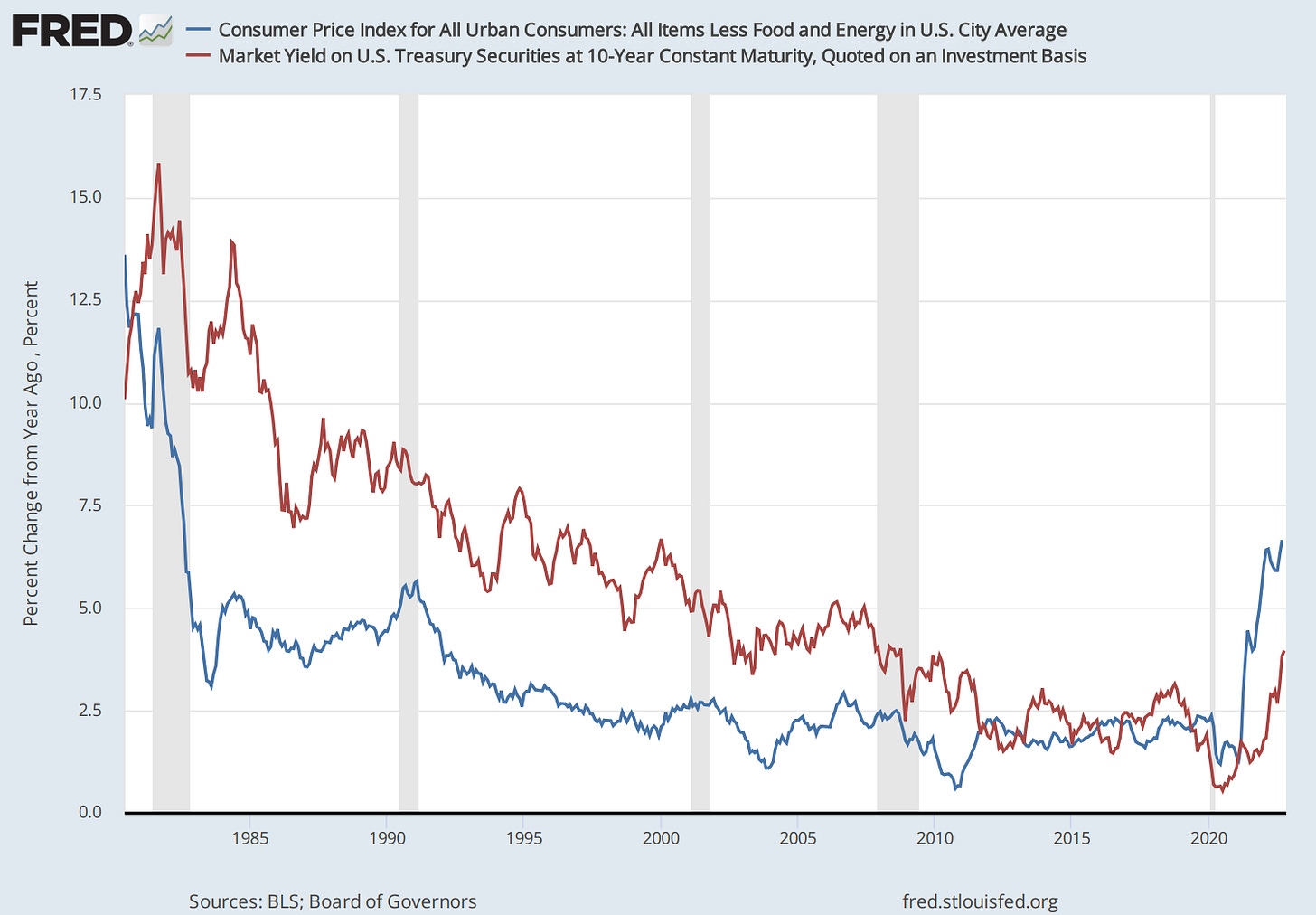

And resulted in a secular decline in U.S. manufacturing employment, inflation, and interest rates.

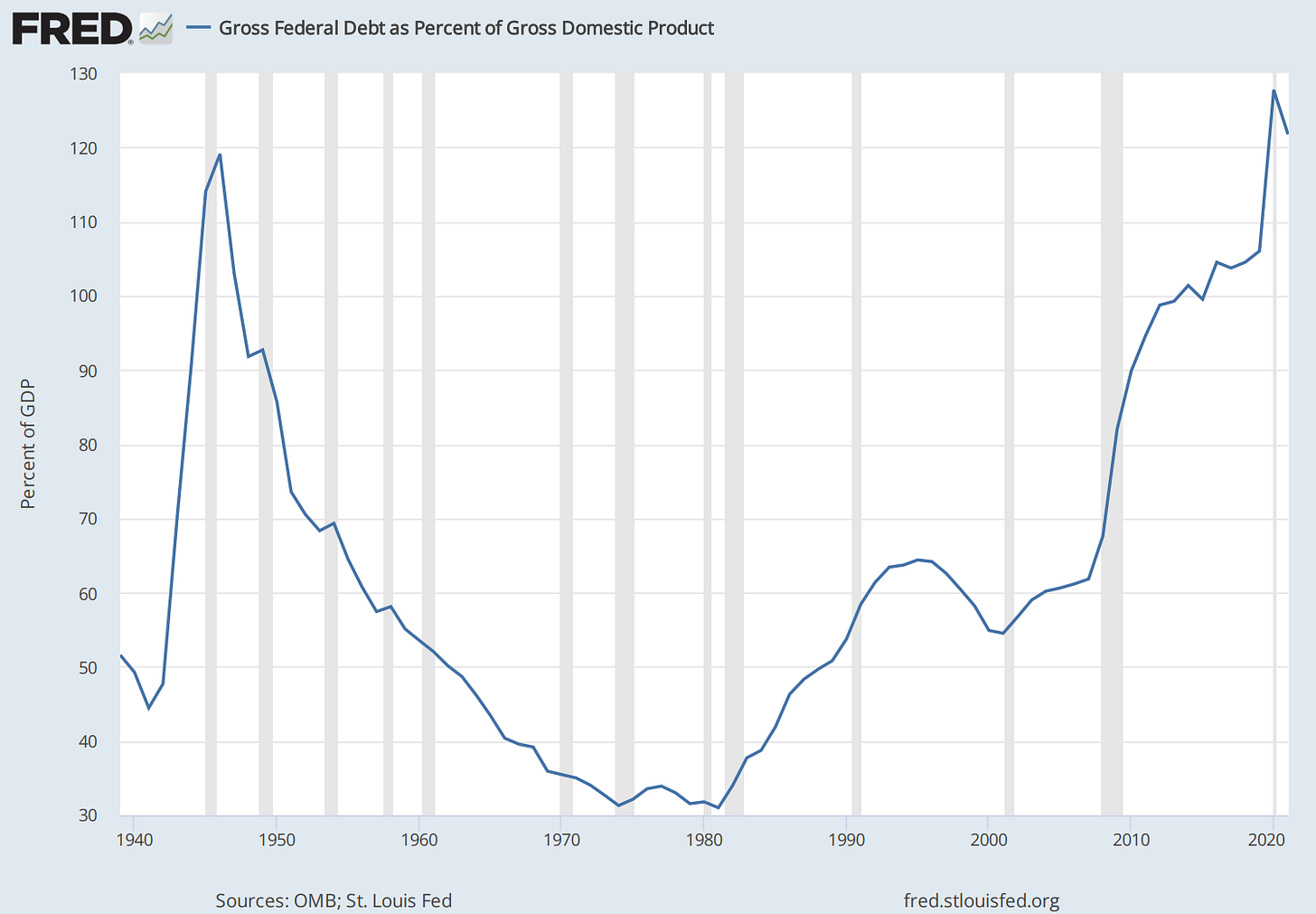

U.S. debt to GDP exploded as interest rates declined, and demand for U.S. debt increased as the world globalized.

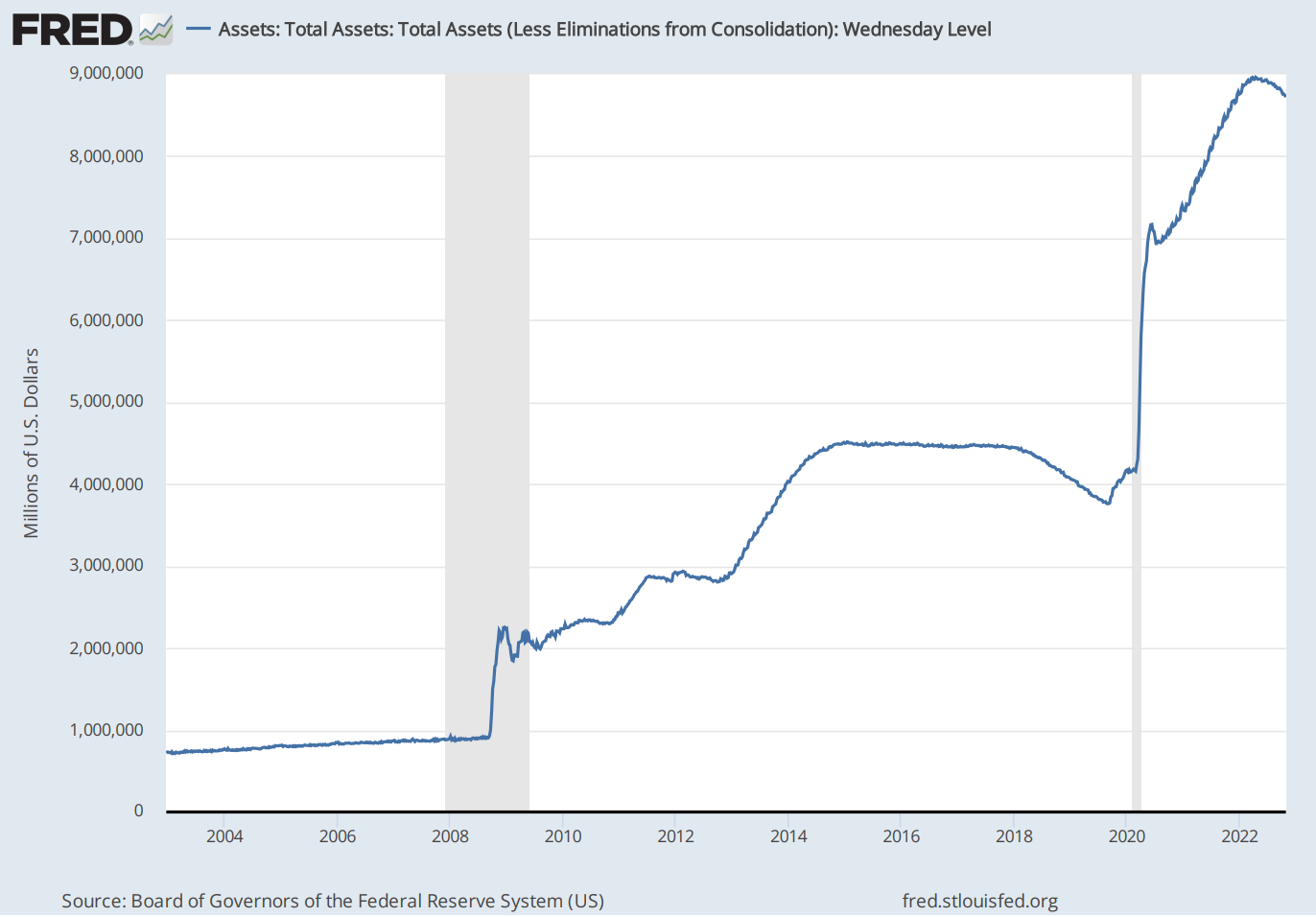

U.S. Household debt to GDP also skyrocketed until the 2008 financial crisis. The Fed came to the rescue by shifting household debt to the central bank’s balance sheet following the crisis and doubled down in the wake of the 2020 pandemic.

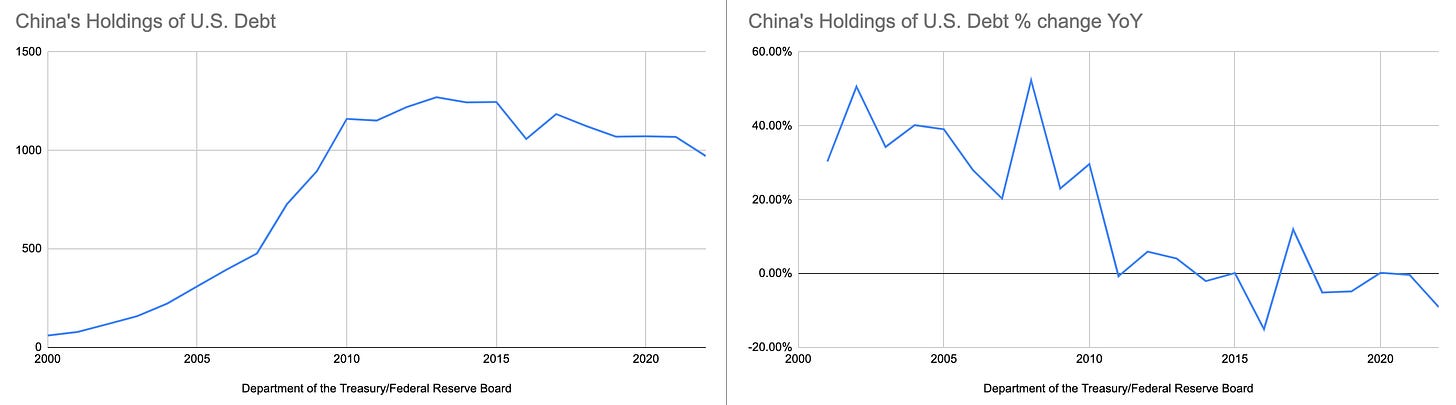

China was once the biggest owner of U.S. debt, but now its ownership is declining.

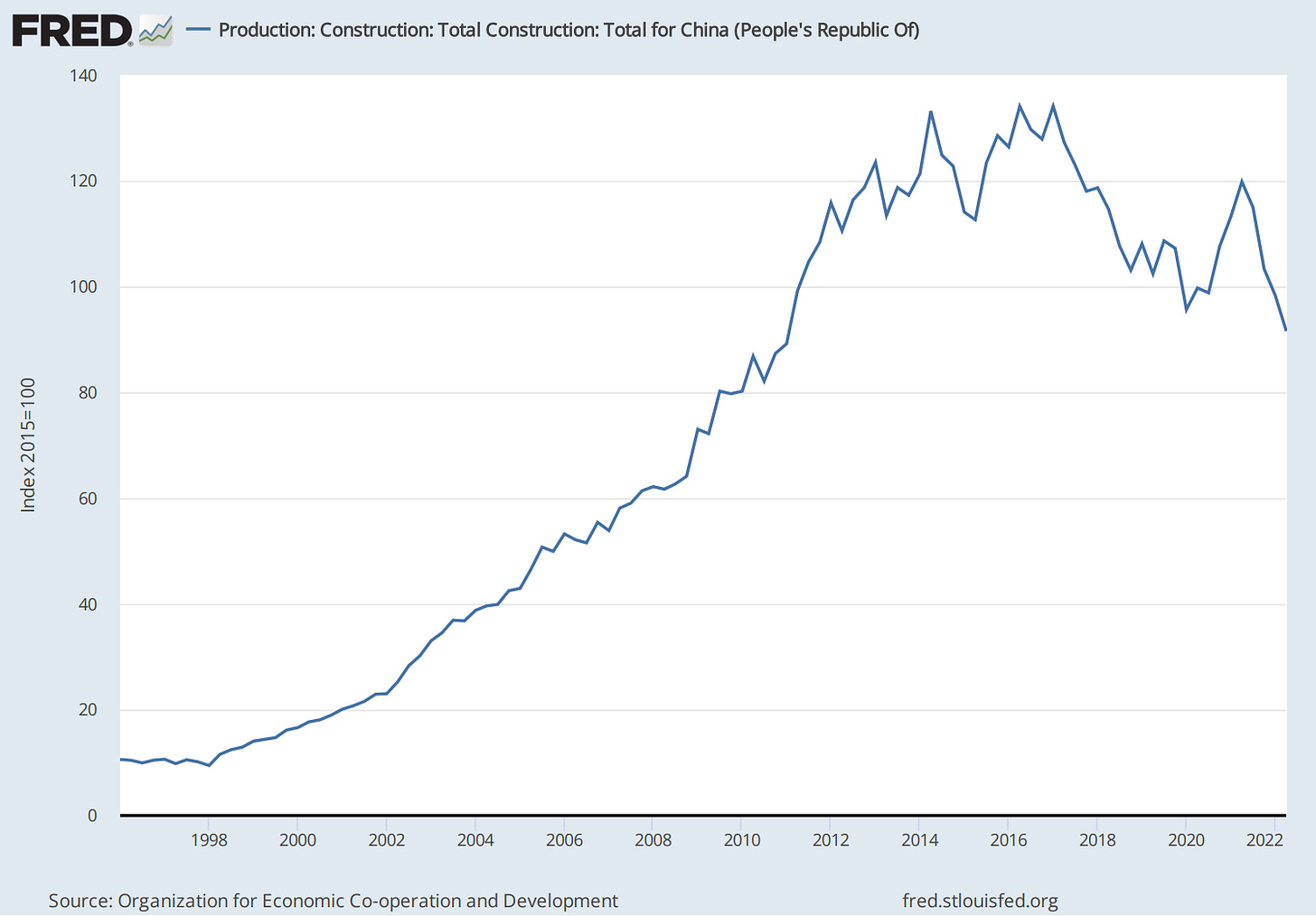

Its decline in U.S. debt ownership mirrors its decline in construction.

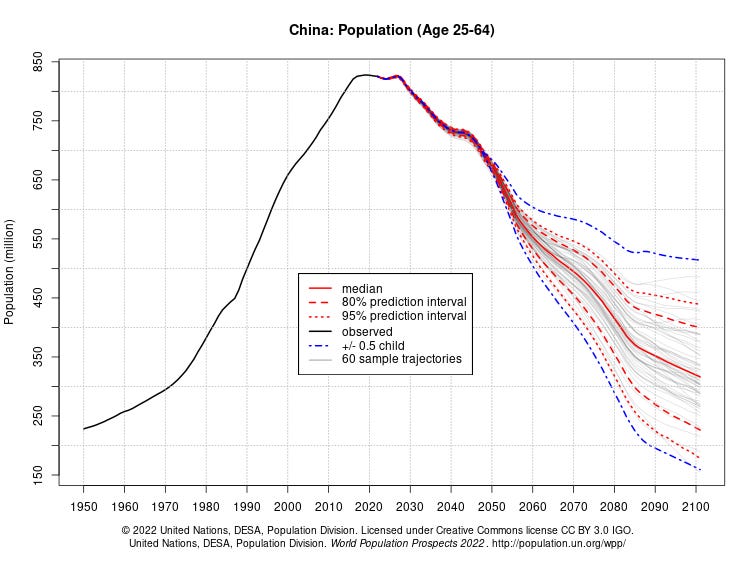

China’s working-age population peaked around 2020 and is projected to decline.

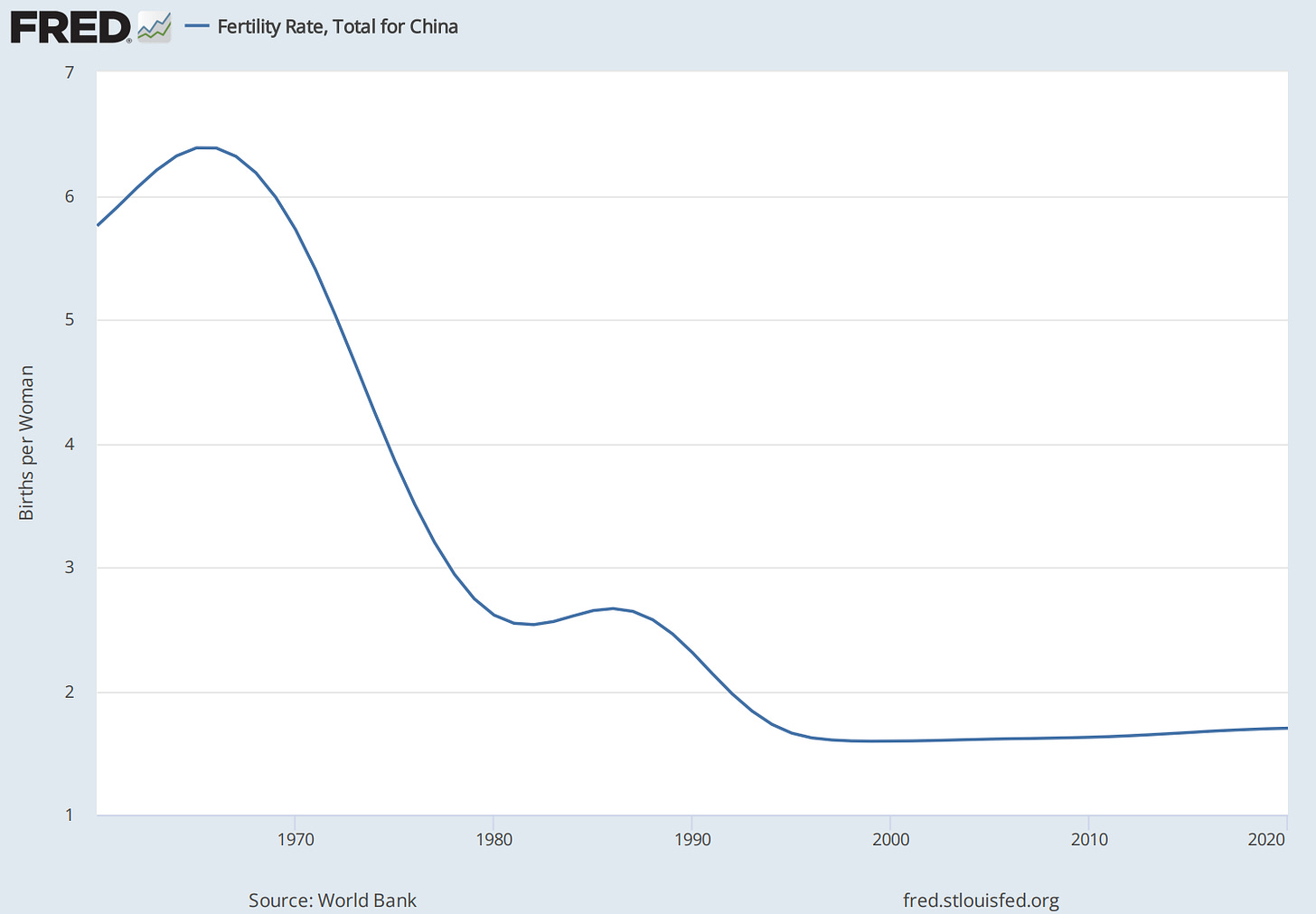

And the fertility rate in China is below replacement levels.

Has China's economic power and ownership of U.S. debt peaked?

If this co-dependent relationship breaks down, how will it impact inflation and interest rates going forward?

Will the net result be the second coming of the U.S. manufacturing base and a renaissance in domestic infrastructure, or will global industrial output stagnate in a world of higher inflation and low growth?